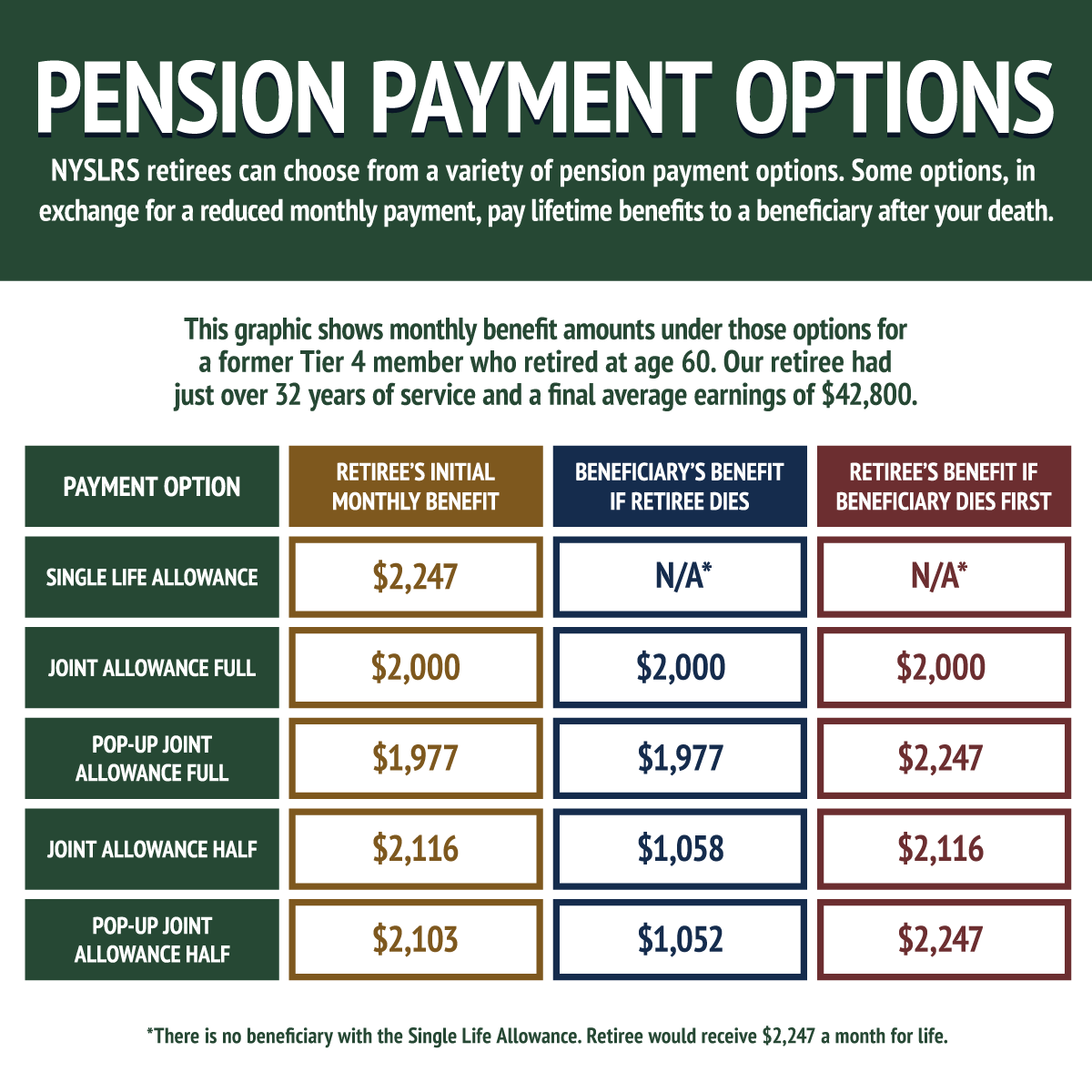

When you apply for a NYSLRS pension, you’ll need to choose a payment option, which determines how your retirement benefit will be paid. All options will provide you with a monthly benefit for the rest of your life. The single life allowance option pays the highest monthly benefit, but all payments stop at your death. If you choose a different option, you may be able to provide a lifetime benefit to a beneficiary.

You can apply for service retirement through Retirement Online. One of the benefits of applying online is that you’ll see a projection of your pension payment under each option before you’re asked to select one. If you submit your retirement application by mail, you’ll need to mail a paper option election form.

Joint Allowance Payment Options

In exchange for a reduction in your monthly payment, joint allowance options pay your beneficiary all or part of your pension after you die. The amount of the reduction in your pension is based on your life expectancy and the life expectancy of your beneficiary. The reduction is permanent even if your beneficiary dies before you do.

You can only choose one beneficiary under a joint allowance option, and you can’t change your beneficiary after you retire, regardless of the circumstances. If your beneficiary dies before you, all payments will stop when you die.

Pop-Up Payment Options

Like joint allowance options, pop-up options allow you to provide a lifetime payment for a beneficiary after your death. But, if your beneficiary dies before you, your future monthly payments will increase to the amount you would have been receiving had you chosen the single life allowance at retirement. (The pop-up only affects future payments. You would not be entitled to any retroactive payments.)

The monthly reduction in your benefit will be greater if you choose a pop-up option over a regular joint allowance.

Payment Options for Multiple Beneficiaries

There are options that allow you to leave a monthly payment to more than one beneficiary, and options that leave a benefit for a certain amount of time. For more information, visit our Payment Option Descriptions page.

Consider Your Decision Carefully

There are many factors that might influence your payment option choice. Your age and overall health, the age and health of your partner, and your loved one’s access to other financial resources should all be considered.

You only have 30 days after the last day of your retirement month to change your option. After that date, you cannot change your option for any reason.

An important step in retirement planning is finding out how much you can expect to receive. Most members can use Retirement Online to create a pension estimate based on the salary and service information we have on file for them. You can enter different retirement dates and beneficiaries to see how they affect your potential benefit and pension payment options. Go to the ‘My Account Summary’ section of your Retirement Online Account Homepage and click the “Estimate my Pension Benefit” button. You can also ask NYSLRS to send you a benefit estimate that calculates your pension under the various options.

Other Death Benefits

Most NYSLRS retirees are eligible for a post-retirement death benefit if they retire directly from payroll or within one year of leaving covered employment. Eligibility depends on your retirement plan and tier. If you are eligible, your beneficiary will receive a one-time, lump sum payment. The amount of the post-retirement benefit is a percentage of the death benefit available during your working years. For information about this and other potential death benefits, please visit our Death Benefits for Retirees page.