Ready to retire? Retirement Online makes it fast and convenient to apply for retirement. There are no forms to mail in and nothing to have notarized. If you don’t already have an account, sign up today.

As a reminder, you must submit your application 15 – 90 days before your retirement date. Before you apply for retirement, make sure you have proof of your date of birth on hand. If you choose a pension payment option that leaves a lifetime benefit to a beneficiary when you die, we will need proof of their birth date too.

Retirement Online Makes It Fast and Convenient to Apply for Retirement

- Sign in to your Retirement Online account.

- Scroll down to the ‘My Account Summary’ section.

- In the ‘I want to…’ section, click the green “Apply for Retirement” button.

From there, you’ll go through a series of screens where you’ll be able to:

- Choose a retirement date;

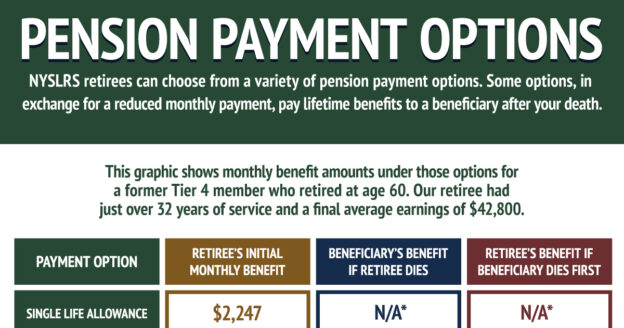

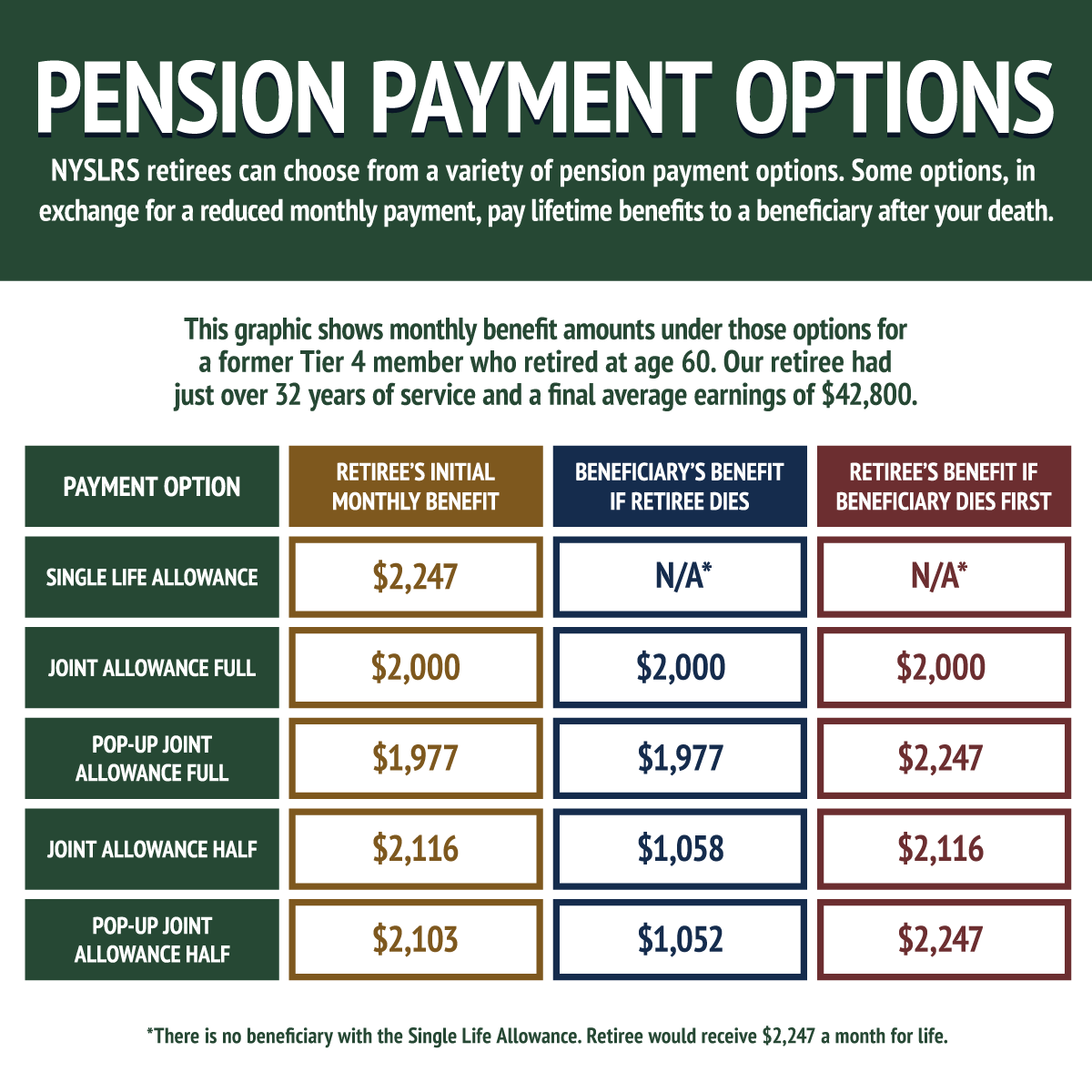

- Get an estimate of your pension and the payment options available to you;

- Select a payment option;

- Enter federal tax withholding information;

- Sign up for direct deposit (have your bank account information ready);

- Upload required documents, such as proof of date of birth;

- Pay off your NYSLRS loan or service credit purchase; and

- Review your employment history.

After you click the “Submit” button, make sure you receive a confirmation message that your retirement application has been successfully submitted before closing your browser.

One Exception — Disability Retirement

NYSLRS provides disability benefits for members who are permanently disabled and cannot perform their duties because of a physical or mental condition. Applications for disability retirement can’t be submitted in Retirement Online. Members who wish to apply for a disability retirement need to submit a paper application. Visit our Disability Benefits page for more information.

For Benefit Information, Read Your Retirement Plan Publication

Your service and disability retirement benefits and death benefits are based on your tier, plan, service credit, and other factors. For comprehensive information about your available benefits, find your NYSLRS retirement plan publication.