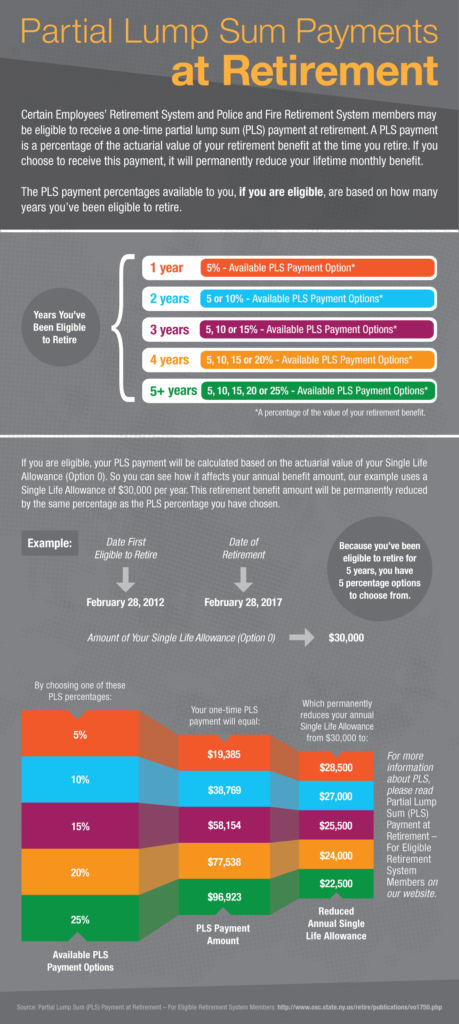

When you retire, you’ll choose a payment option for your monthly lifetime benefit. Eligible NYSLRS members may also choose to receive a partial lump sum payment. The payment, which you’ll receive when we finish calculating your pension benefit, is a percentage of the actuarial value of your retirement benefit at the time you retire. By accepting this one-time lump sum payment, your lifetime monthly benefit will be permanently reduced.

Who is Eligible for the Partial Lump Sum Payment?

If you’re a Police and Fire Retirement System (PFRS) member covered by a special 20- or 25-year plan, you may be eligible to choose this payment. Certain Employees’ Retirement System (ERS) members (sheriffs, undersheriffs, deputy sheriffs, and county correction officers) are eligible if their employer offers this benefit. (Read the other eligibility requirements for PFRS members and ERS members.)

How the Partial Lump Sum Payment Works

How the Partial Lump Sum Payment Works

The percentage amounts you can choose from depend on how long you’ve been eligible to retire. You can choose a lump sum payment that equals 5, 10, 15, 20 or 25 percent of the value of your retirement benefit.

The payment can be made directly to you, or you can also have it paid in a direct rollover to an Individual Retirement Annuity or other plan that accepts rollovers. Before you decide, you may want to speak with a tax advisor to see if the partial lump sum payment is right for you. Certain partial lump sum distributions could be subject to federal income tax.

How Do I Choose the Partial Lump Sum?

If you’re eligible for the partial lump sum, we’ll send you a special option election form when you file for retirement. You can use this form to choose both the partial lump sum and the payment option you want for your continuing lifetime monthly benefit.

Please read Partial Lump Sum (PLS) Payment at Retirement – For Eligible Retirement System Members for more information.