Your Retiree Annual Statement is now available in Retirement Online! Retirees who opted to go paperless already received an email notifying them that their Statement is available in their Retirement Online account.

If you did not change your delivery preference to email, your Statement will be mailed by the end of February.

Get Your Statement Online Now

Whether you chose email delivery or not, you can access your Statement in your Retirement Online account now. To view, save or print your Statement:

- Sign in to Retirement Online.

- From your Account Homepage, click the “View My Retiree Annual Statement” button.

- Follow the prompts.

If you don’t have an account, you can find step-by-step instructions for registering in the Tools & Tips section of the Retirement Online page.

Inside Your Retiree Annual Statement

Your Statement has a new look this year, but it still contains the same information you receive every year about your benefit amount, deductions and tax withholding. Your Retiree Annual Statement includes:

- Your NYSLRS ID. To protect your privacy, use this number instead of your Social Security number when conducting business with NYSLRS.

- The total amount of your annual benefit. (This is your base benefit, before taxes, deductions and credits.)

- Your total net benefit for the year. (This is your benefit after taxes, deductions and credits.)

- The total amount of any cost-of-living adjustment (COLA), if you are eligible.

- Your total Medicare credits (if eligible).

- Federal tax withholding (if applicable).

- Other deductions taken from your pension, such as payments to an alternate payee or union dues.

- Health insurance premiums. (NYSLRS doesn’t administer health insurance benefits, but we deduct retiree premiums at the request of your former employer.)

Next Year Don’t Wait for the Mail

Going forward, your Statement will be available online in early February each year.

Update your delivery preference now to receive an email as soon as next year’s Retiree Annual Statement is available online:

- Sign in to Retirement Online.

- From your Account Homepage, click the “update” link next to ‘Retiree Annual Statement by.’

- Choose “Email” from the dropdown.

If you choose to receive your Statement by email, you will not receive a printed copy in the mail.

Use Retirement Online to Stay Informed

Your Statement is a snapshot of your NYSLRS account as of December 31, 2023. For the most up-to-date information year-round, sign in to Retirement Online. If you don’t already have an account, you can learn more or register today.

In Retirement Online, you can view pay stubs for your benefit payments. Check them if you have a question or to track year-to-date totals of your pension benefit as well as any deductions for health insurance, union dues, tax withholding or disbursements under a domestic relations order.

Your Statement is Not a Tax Document

While your Retiree Annual Statement does include information about your benefit payments and tax withholding, it is not a tax document. If your pension is taxable, you should have received a 1099-R tax form (either through your Retirement Online account or by mail, depending on your delivery preference) for filing your taxes.

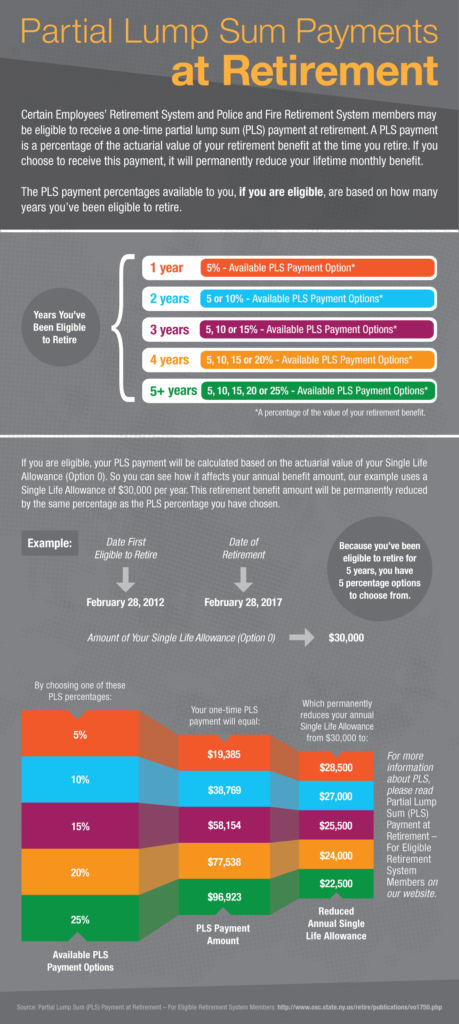

How the Partial Lump Sum Payment Works

How the Partial Lump Sum Payment Works