Becoming vested is a crucial milestone for NYSLRS members. It means you have earned enough service to qualify for a retirement benefit once you meet the age or service requirements established by your retirement plan. Vesting is automatic — you don’t have to fill out any paperwork to become vested.

Years of Service Credit to Become Vested

NYSLRS members in Tiers 2 – 6 need five years of service credit to be vested.

If you work part-time, or if you have an unpaid leave of absence, it will take longer to become vested. For example, if you work half-time, you earn six months of credit toward vesting for each year on the job.

Sign in to your Retirement Online account to check your total estimated service credit and whether you are vested.

If you work for a school district, read our How School Employees Earn NYSLRS Service Credit blog post for information about how your service credit is determined.

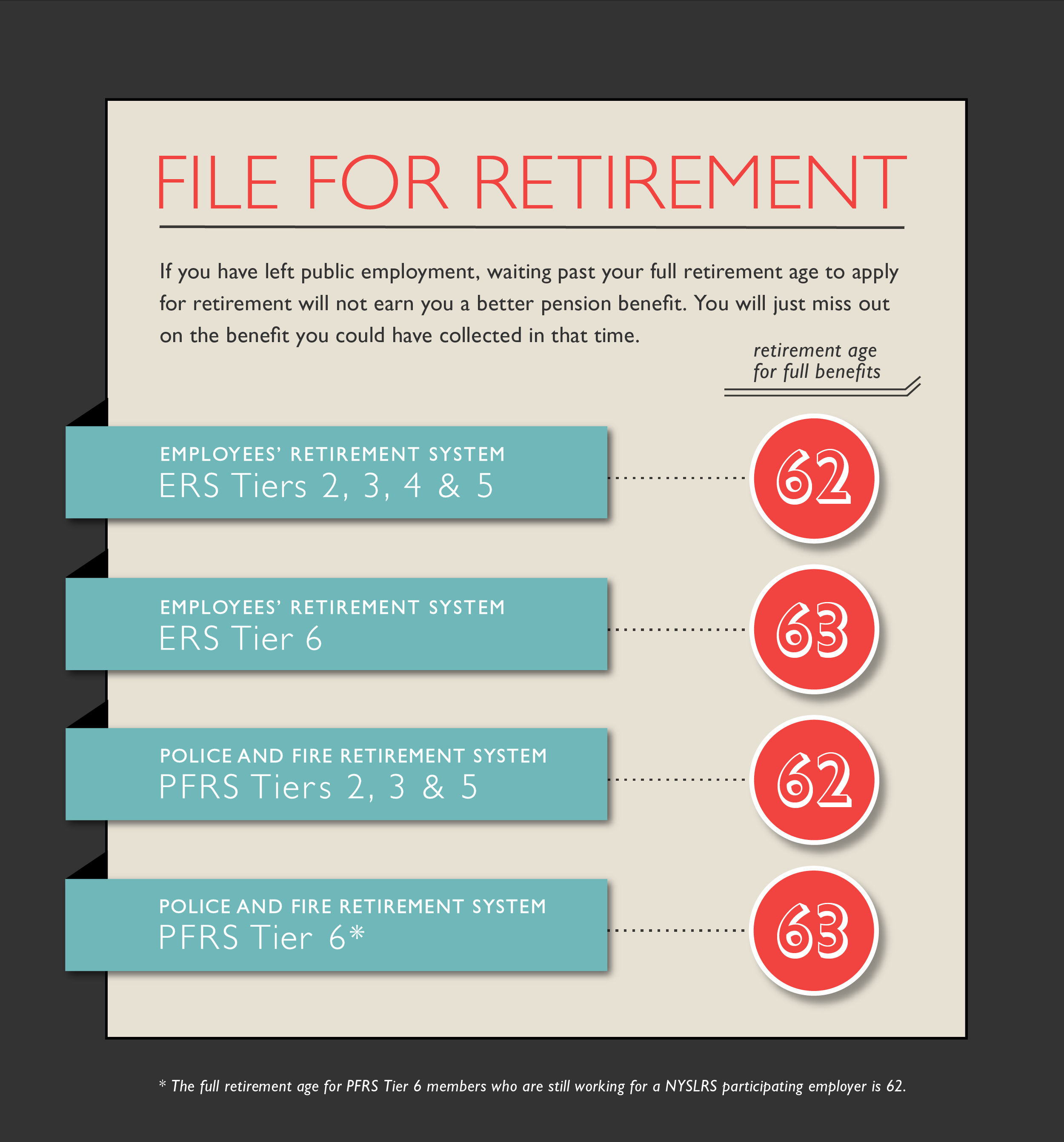

Note: Previously, Tier 5 and 6 members needed ten years of service to be eligible for a service retirement benefit. However, as of April 9, 2022, these members only need five years of service credit to be vested. The new law did not change benefit rules such as how long members must contribute, pension benefit calculations, the full retirement age, reductions to retire early or the cost to purchase previous service.

Applying for Retirement

Vesting is automatic, but you will need to apply for retirement to receive your pension — NYSLRS will not pay out your pension benefit unless you apply for it.

Pension eligibility requirements and benefit calculations depend on your tier and retirement plan. To find your tier and retirement plan, sign in to your Retirement Online account and go to the ‘My Account Summary’ section. Once you know your tier and retirement plan, you can find your retirement plan publication for comprehensive information about your benefits and filing instructions.

And when you’re ready, you can apply for a service retirement benefit quickly and easily using Retirement Online.

If you leave public employment, read about the age requirements for filing for a vested retirement benefit as well as other important information that you should know about your NYSLRS membership and benefits.