Financial security doesn’t just happen; it takes planning … and time. You know you can count on your pension income in retirement. But if you want to improve your chances of a financially secure retirement, you should have a retirement savings plan. The sooner you do that, the better, because it’s important to start saving and investing early so your money has time to grow.

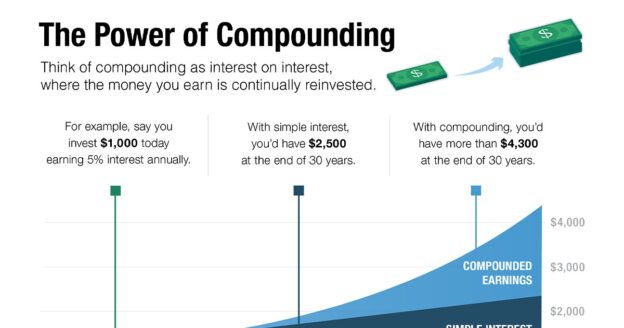

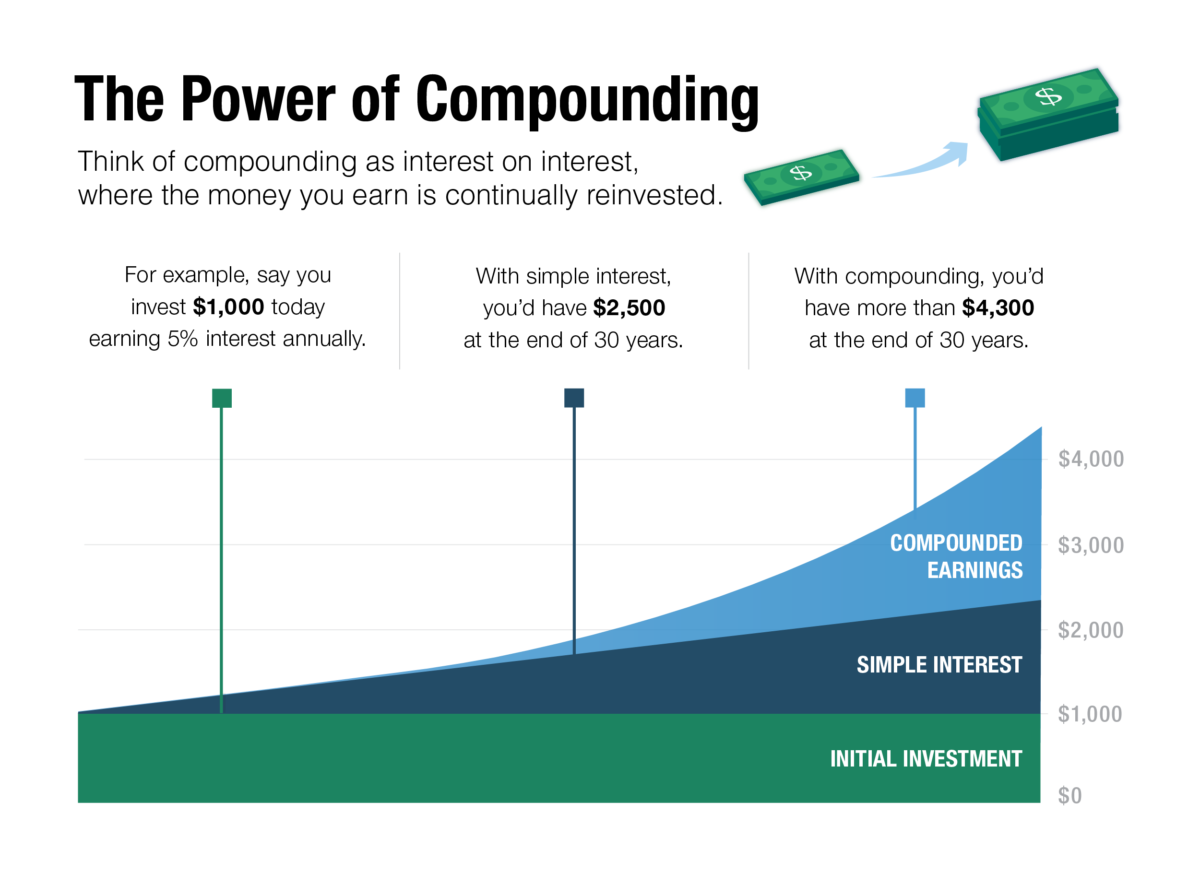

When you invest in a retirement savings plan such as an IRA or 457(b), you earn a return on your investment, and your returns are compounded. That means your money increases in value by earning returns on both the original amount and accumulated profits. This is a little different from earning simple interest. Let’s see how they both work.

How Simple Interest Works

In banking, simple interest is a certain percentage you are paid on the money you put in your account. With simple interest, the amount of interest you earn is based on the original (or principal) amount of the deposit.

Let’s say you opened a savings account and deposit $1,000 in January. If the bank paid 5 percent annual interest on that deposit, you’d receive five cents for every dollar in your savings account each year. At the end of one year, you’d have $1,050. That’s $50 more than the principal amount you started with. With simple interest, the interest you earn every year would still be based on the principal amount of $1,000 — no compounding.

How Compounding Works

With compounding, your initial investment plus your earnings are reinvested. If you earn the same 5 percent, with compounding, it’s applied to the full balance of your account. So, you would still have that $1,050 at the end of the first year, but by the end of the second year you’d have $1,102.50 in your account instead of $1,100.

In this example, that’s just a difference of $2.50, but, over time, compounding can mean a difference of hundreds or thousands of dollars.

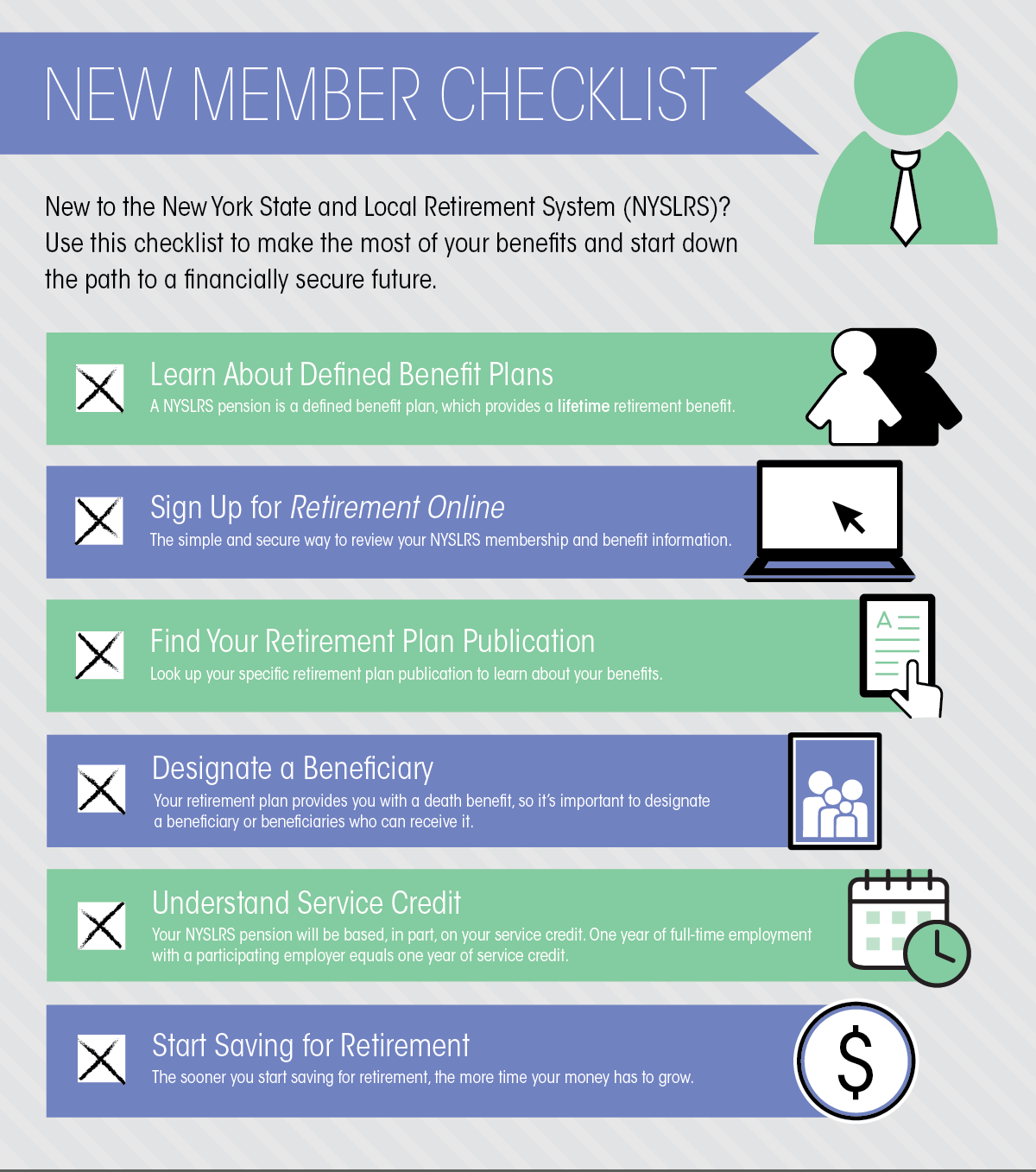

If you’re thinking about boosting your personal savings for retirement, look for accounts that use compounding. For example, the New York State Deferred Compensation Plan (NYSDCP) is the 457(b) plan created for New York State employees and employees of other participating public employers in New York. The sooner you can start saving, the more time your money has to grow.

Other Sources:

How to Calculate Simple and Compound Interest