If you served in the U.S. Armed Forces, you may be eligible to buy back up to three years of active service credit. Because service credit is a factor in calculating a NYSLRS pension, in most cases buying military service credit will increase your pension.

To be eligible, veterans must:

- Have been honorably discharged;

- Have at least five years of credited service in the Retirement System;

- Have not received credit for this service in any other public retirement system in New York State; and

- Apply for and purchase military service credit before they retire.

How to Apply for Military Service Credit

To apply and request a cost for military service credit:

1. Fax your name, contact information and a copy of your DD-214 to 518-486-6405 or 518-402-7799;

or

2. Mail a letter with your name and contact information, and a photocopy of your DD-214, to:

Military Service Unit

110 State Street

Albany, NY 12244-0001

If after reviewing your application we determine you are eligible, we will send you a letter that will tell you how much credit you are eligible to purchase and the cost. Most members in Tier 1, 2, 3 or 4 can use our online benefit projection calculator to see how the credit would impact your pension. Tier 5 and 6 members can get that information by calling 1-866-805-0990, or using our secure email form (www.emailNYSLRS.com).

For more information, visit the Military Service Credit page on our website.

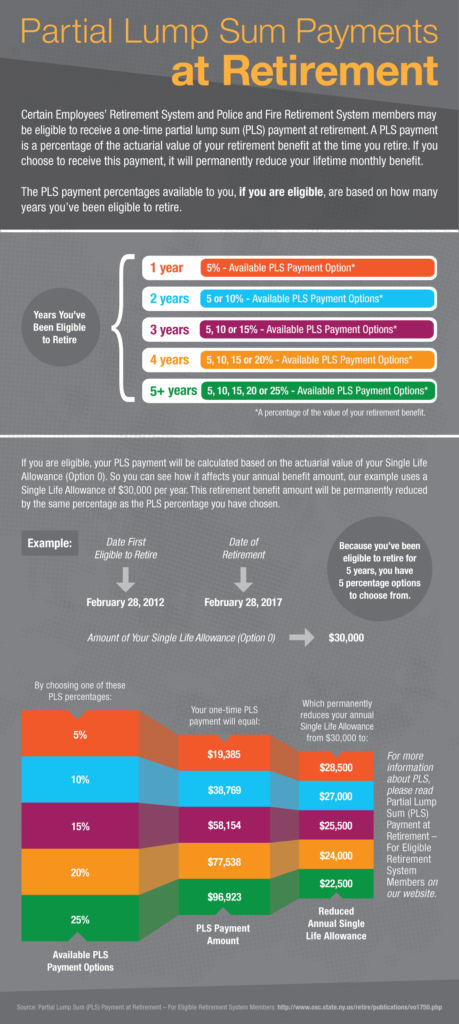

How the Partial Lump Sum Payment Works

How the Partial Lump Sum Payment Works

Filing Forms with the Comptroller

Filing Forms with the Comptroller