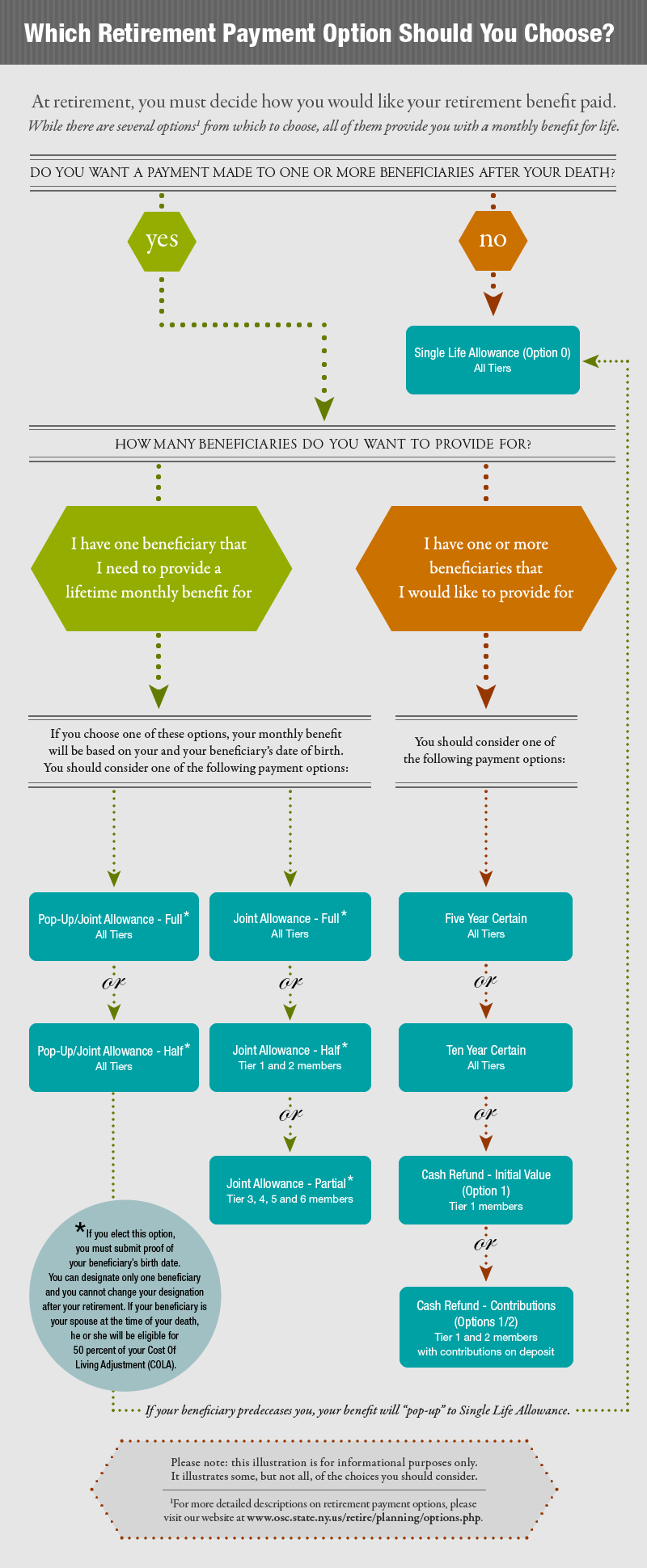

When you retire, you need to decide how we’ll pay out your retirement benefit. You do that by choosing a pension payment option. Each payment option provides you with a monthly benefit for life. Nine of our payment options let you receive a smaller benefit so you can provide for a beneficiary when you die. There is also an option that pays you the largest amount of your benefit, but pays nothing to a beneficiary.

Read the full descriptions of our payment options on our website.

Filing Your Option Election Form

When you’ve decided which payment option you’d like, you need to file an option election form. You must file before the first day of the month following your retirement date. If you file on time, you have 30 days before you receive your first benefit payment to change your payment option. If you miss this deadline, we’re required by law to process your benefit based on the basic retirement benefit listed in your plan. (The Single Life Allowance (Option 0) is the basic retirement benefit for some plans, while the Cash Refund — Contributions (Option ½) is the basic retirement benefit for others. Check your retirement plan publication to see what your options are.)

What To Consider When Choosing A Payment Option

Choosing your payment option is a big decision. Once the 30-day deadline has passed, you can’t change your payment option. Here are some questions to ask yourself:

- Do you want a payment made to one or more beneficiaries after your death?

- Do you know about your beneficiary’s future income in retirement? Will your beneficiary receive their own pension? How much will they receive from Social Security benefits or other retirement savings accounts?

- Do you have life insurance coverage? Life insurance payments could help your beneficiary make ends meet.

- What are your financial obligations? Will your beneficiary have enough income to cover expenses if you die?

The answers to these questions can help you decide which option meets your needs. If you have any questions, email us from our website.

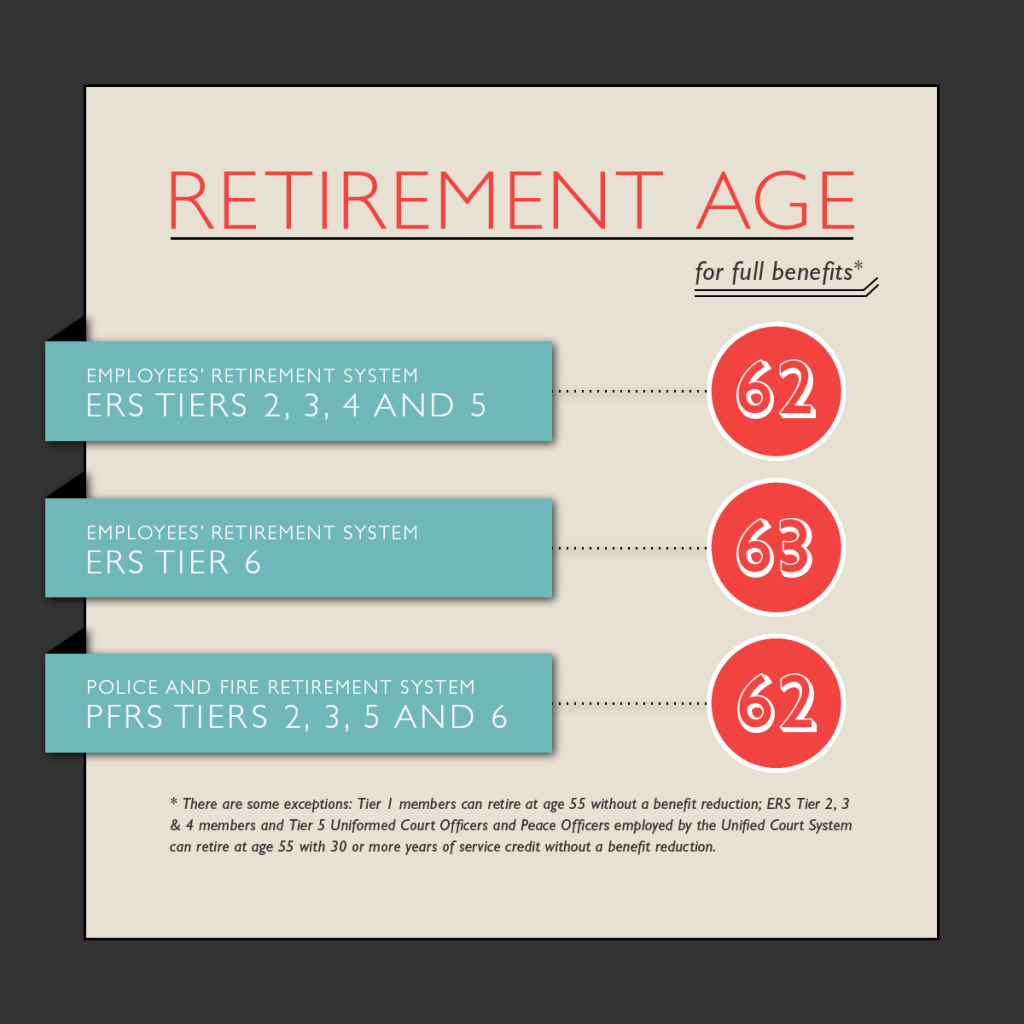

Would you like to read more NYSLRS Basics posts? Check out our earlier post on when you can retire.