The final months leading up to your retirement date go by quickly. When you are 12 months from your planned retirement date, you should consider your post-retirement finances. Putting together a good picture of your expected income and expenses should be a big part of your countdown to retirement.

Estimate Your Pension

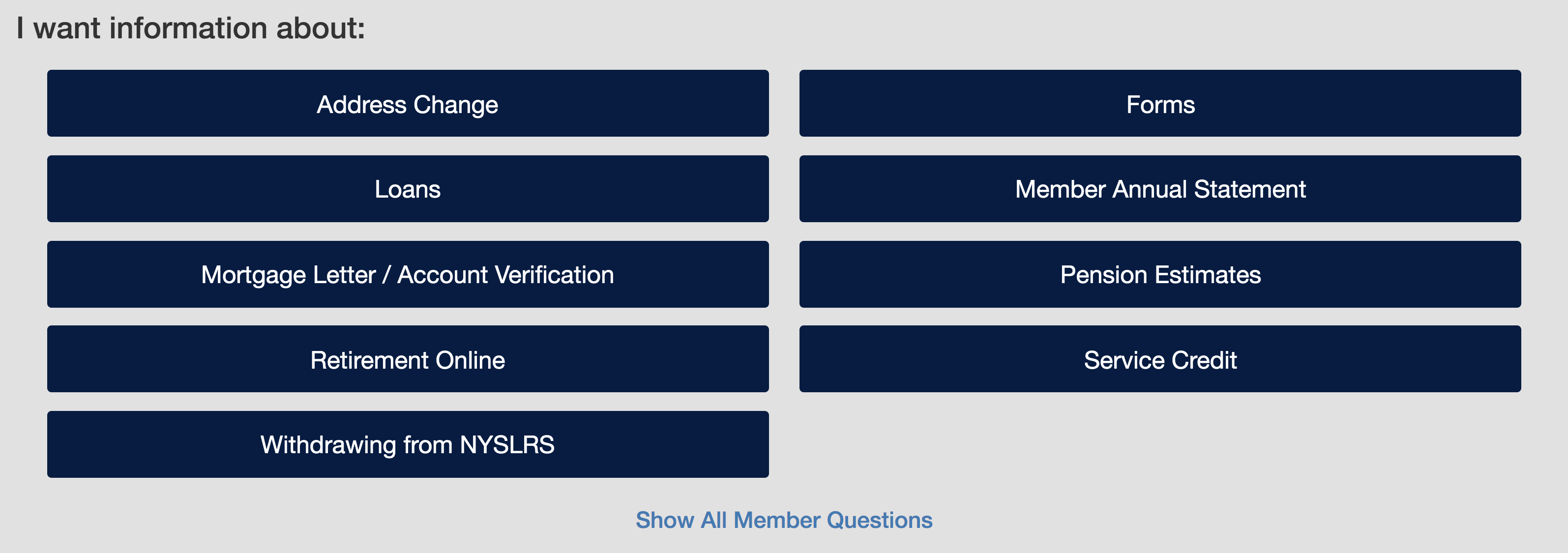

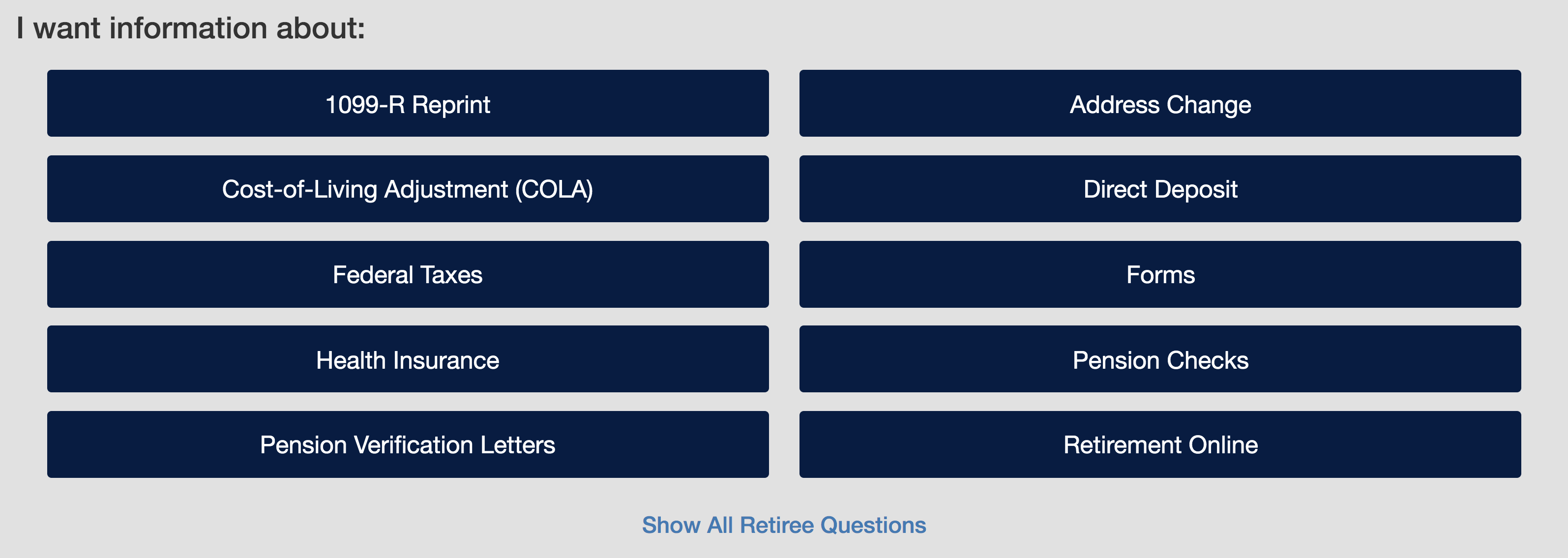

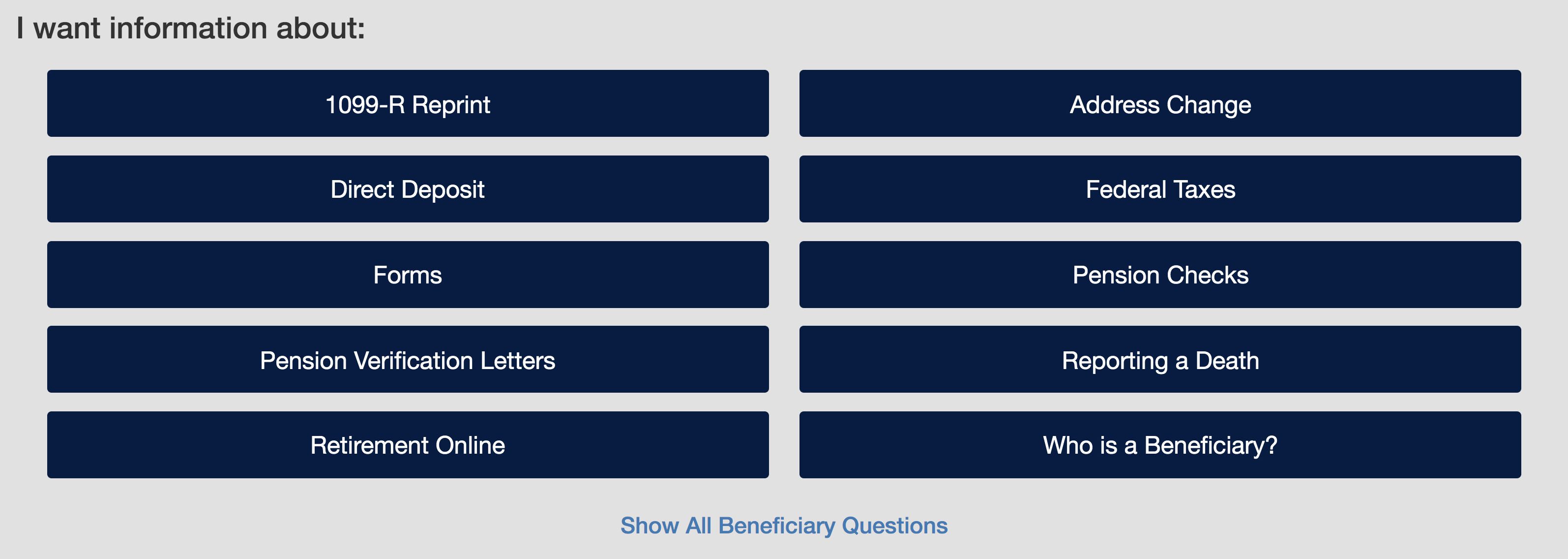

Your NYSLRS pension is likely to be a major source of retirement income, but how much will you get? Most members can estimate their pension in Retirement Online.

A Retirement Online estimate is based on the account information we have on file for you. You can enter different retirement dates to see how an earlier or later date would affect your benefit.

If you are unable to use the online calculator, you can request a benefit projection by calling our toll-free number at 866-805-0990 or by submitting a Request for Estimate form. Also, most Tiers 2 through 6 members can use the Quick Calculator on the NYSLRS website.

Review Other Retirement Income

One year out is a good time to take a closer look at other sources of retirement income. If you have an account with the New York Deferred Compensation Plan, review your latest statement. If you have an old 401(k) or IRA from another job, you should review those plans as well.

Social Security is a major source of income for most retirees. Although most NYSLRS members can retire as early as age 55, you cannot start collecting Social Security retirement benefits until age 62. Your Social Security benefits will be reduced permanently, however, if you retire before your full Social Security retirement age. You should still familiarize yourself with the program and estimate how much you’ll get. The Social Security Administration has several benefit calculators on its website to help you do that.

Review Your Health Insurance Coverage

NYSLRS doesn’t administer health insurance benefits, but health care can be a significant retirement expense you’ll need to plan for. Check with your employer’s health benefits administrator to determine what coverage you’re eligible for once you retire. Now is the time to research private health insurance plans if you’re not eligible for post-retirement coverage or if you need to supplement it.

If you are a New York State employee, you may want to review the Planning for Retirement guide from the Department of Civil Service.

If you’re close to age 65, learn more about Medicare benefits.

Make a Retirement Budget

How much will you spend each month after you retire? By preparing a post-retirement budget before you retire, you can set goals and establish guidelines that can help you stay on track throughout your retirement.

One of the best ways to plan for the future is to track what you spend now. For a more realistic budget, keep a record of your current spending for a month or two to get an idea of your expenses. Be sure to factor in periodic expenses, such as car insurance or property and school taxes.

To help you with your retirement budget, we’ve created monthly income and expense worksheets. These forms can help reveal your current spending habits and assist you in projecting your future needs.

Counting Down

Your planned retirement date will be here before you know it. If you missed it, you may wish to read our earlier Countdown to Retirement post. You’ll also want to keep an eye out for rest of this series for steps to take at four-to-six months and one-to-three months before your retirement date.