Whether you just joined or you’re a longtime member, you likely have questions about your NYSLRS membership. What is vesting? What are final average earnings? What tier are you in, and why does it even matter?

Basic Concepts of NYSLRS Membership

While NYSLRS administers many different retirement plans, the core concepts of our memberships are the same. Your pension will be calculated using a preset formula based on your earnings and years of service. To better understand your NYSLRS benefits, you should become familiar with these four basic concepts:

- Tier. Your tier is based on the date you joined NYSLRS and helps determine the benefits available to you. If you’re a new NYSLRS member, you’re likely in Tier 6. Tier 6 members joined NYSLRS on or after April 1, 2012.

- Service Credit. Generally, you earn a year of service credit for each year you work for a participating NYSLRS employer. Part-time work is prorated. Your total service credit at retirement is a major factor in determining the amount of your pension.

- Vesting. You become vested after you earn five years of service credit. It’s a significant milestone, because once you’re vested, you’re eligible for a NYSLRS pension when you reach retirement age, even if you leave public service.

- Final Average Earnings. Final average earnings are the average of your earnings during the period when your pay is highest. It’s another major factor in determining the amount of your pension.

Your NYSLRS Pension and Other Benefits

As a NYSLRS member, you are part of a defined benefit retirement plan. This means your NYSLRS pension will be a lifetime benefit based on your final average earnings and service credit, not on the contributions you make toward your retirement.

Your NYSLRS membership also provides other important benefits, including:

More Information

We want to make sure you have the information you’ll need to plan for your retirement and make critical decisions about your future. Here are some resources available to you:

Retirement Online is the quickest way to access account information such as your tier, retirement plan and estimated total service credit. If you don’t already have one, sign up for a Retirement Online account now.

Explore the NYSLRS website to learn more about your NYSLRS membership. Our Welcome New Members page explains more about the benefits that are available to you. Your retirement plan publication offers a comprehensive overview of your benefits, and you can find it with our Find Your NYSLRS Retirement Plan Publication tool.

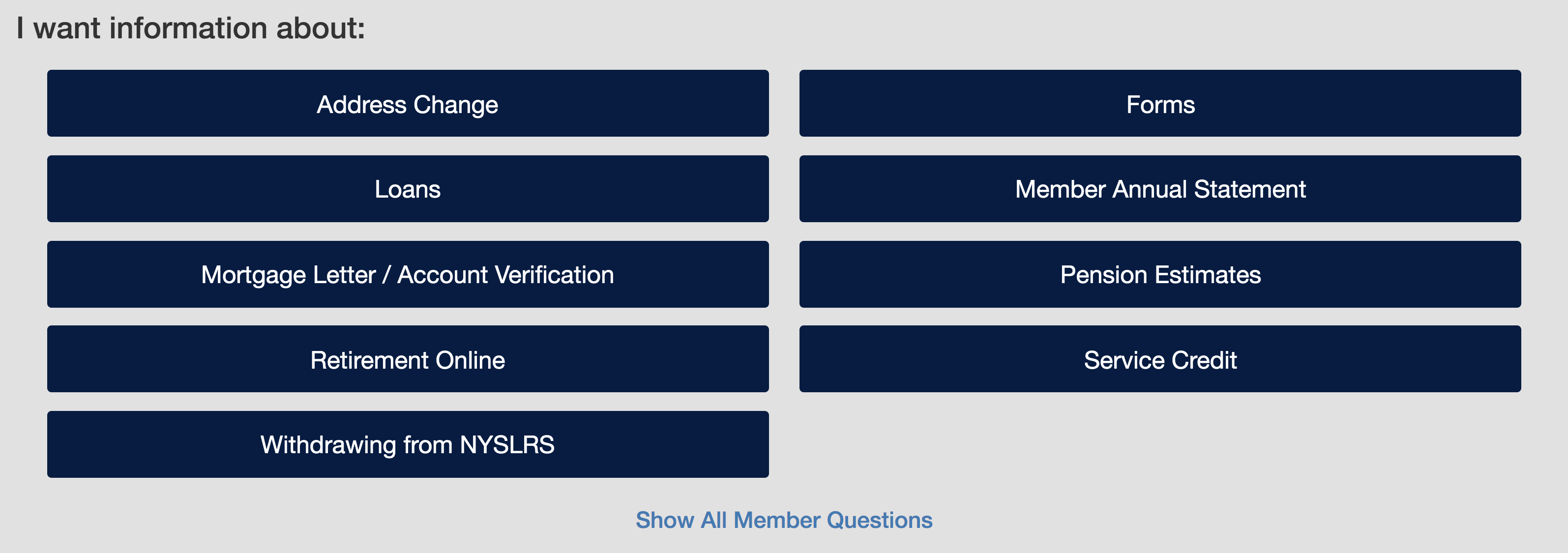

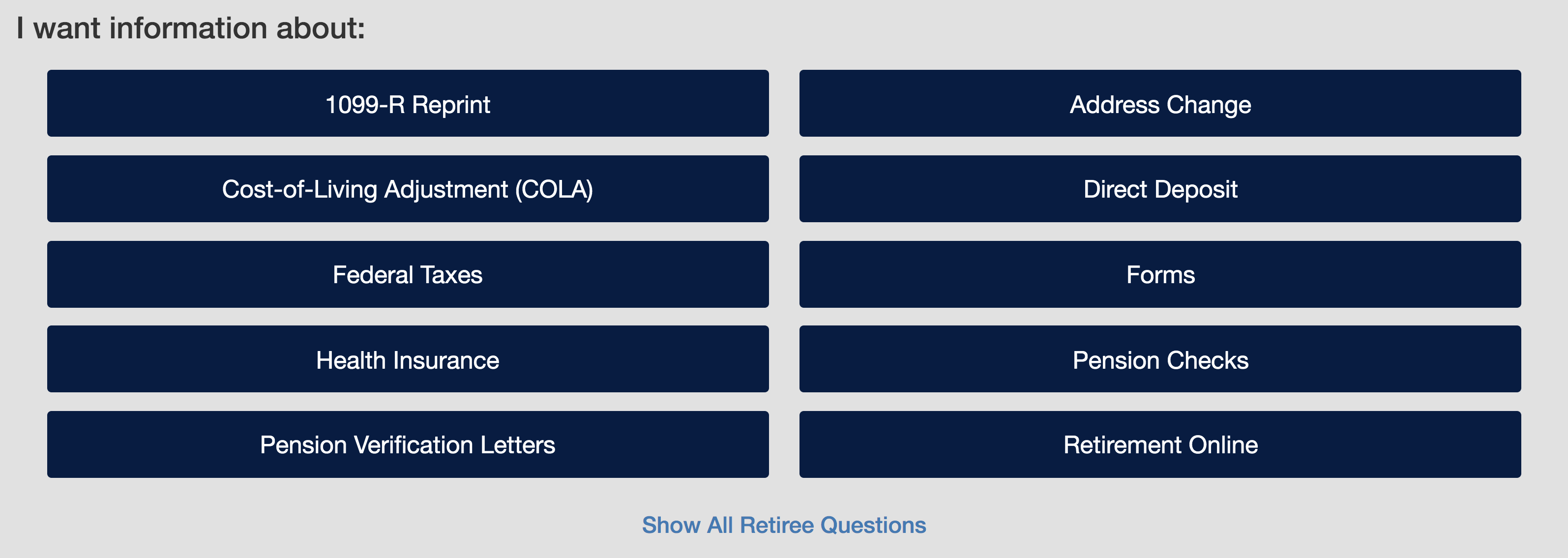

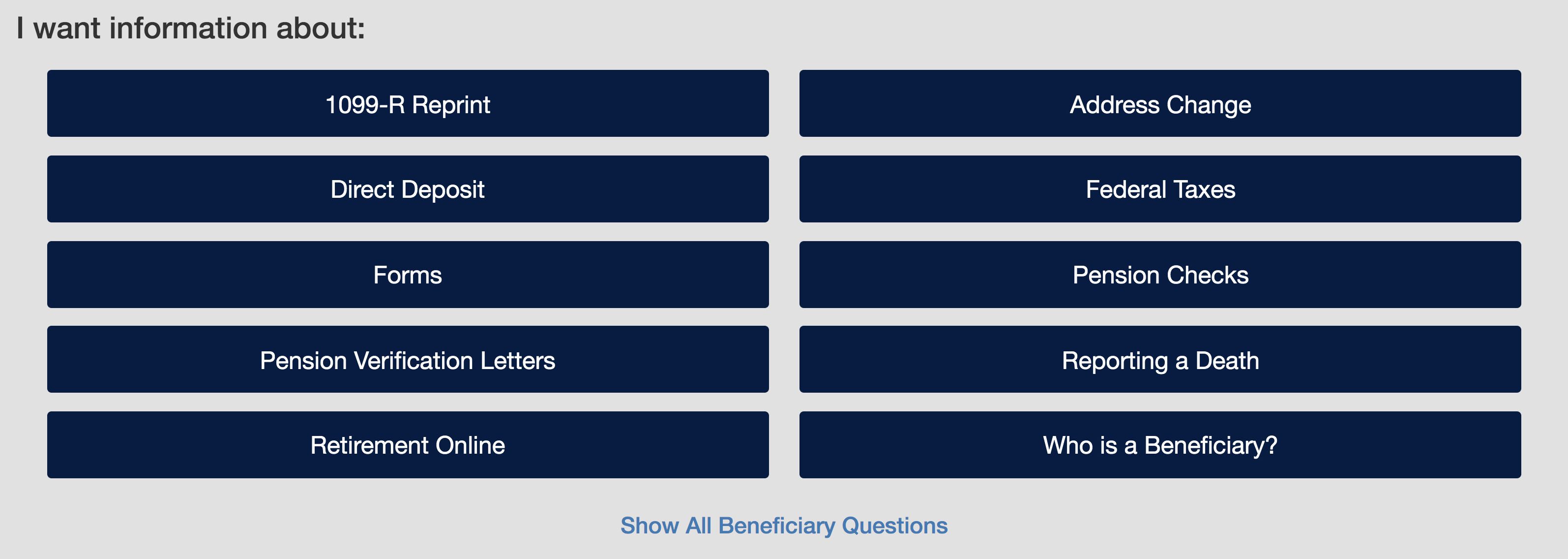

If you have questions about your account or your NYSLRS benefits, please message us using our secure contact form.