More than 480,000 members and retirees have discovered that Retirement Online is the fastest way to do business with NYSLRS. It’s secure and convenient, and helps you avoid calling or mailing forms. It also gives you instant access to information about your benefits. And, your important documents will be available online, sooner than printed copies are mailed.

Retirees Can Do Even More in Retirement Online

The Fastest Way to Get Your 1099-R Tax Document

With Retirement Online, you can get the tax information you need faster. If you receive a taxable benefit from NYSLRS, your 1099-R is now available online. Sign in to view, save or print your tax form for 2023.

View Your Retiree Annual Statement Online

Your Retiree Annual Statement provides important information about your benefit amount, deductions and tax withholding. Beginning with your 2023 Statement, you can now access it in Retirement Online.

Make the Switch to Email and ‘Go Green’

Be the first to know when documents are available online — email delivery gives you access to your important documents sooner. It also helps the environment by reducing paper consumption. ‘Go green’ by choosing the paperless option.

It’s easy to make the switch. To receive an email when your 1099-R tax form and Retiree Annual Statement are available in Retirement Online next year:

- Sign in to Retirement Online.

- From your Account Homepage, click the “update” link next to ‘1099-R Tax Form Delivery by’ or ‘Retiree Annual Statement by.’

- Choose “Email” from the dropdown.

Be sure to check that the email address listed in your Retirement Online profile is current.

If you choose the email delivery preference, you will not receive a printed copy in the mail.

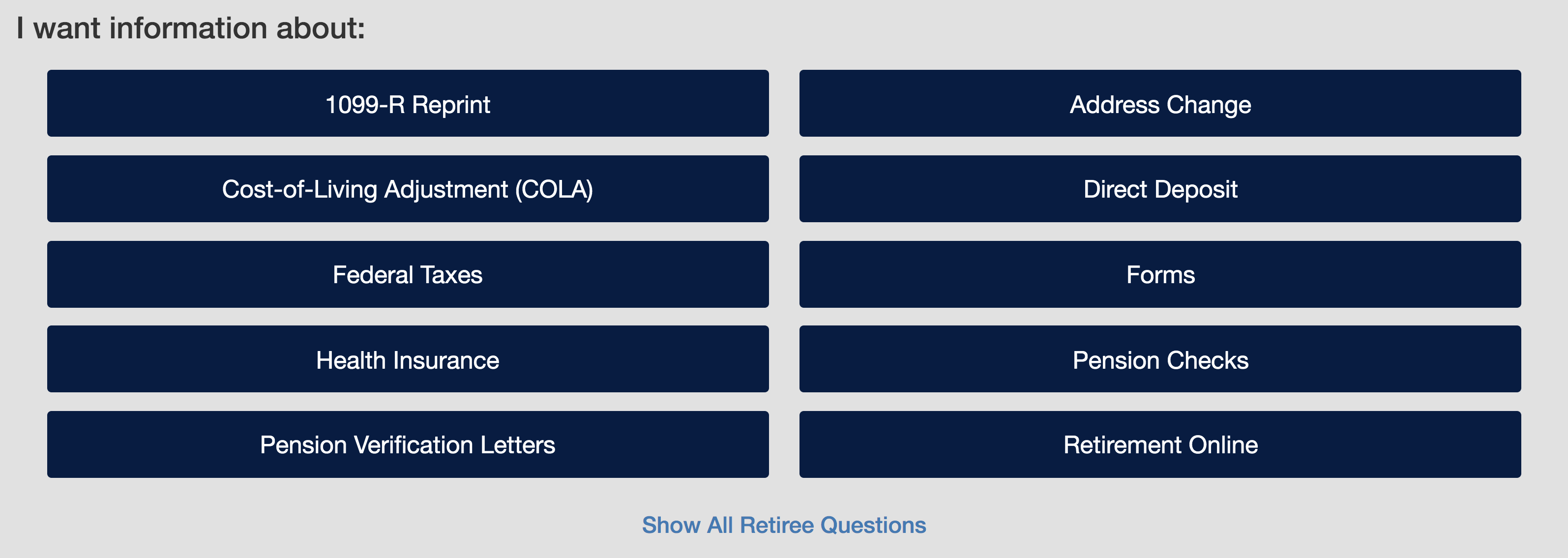

Don’t Forget These Timesaving Features

Change Your Federal Tax Withholding

No forms needed — Retirement Online is the fastest way to update your withholding. If you submit your changes by the middle of the month, they will generally be applied to that month’s payment.

Generate a Pension Verification Letter

There are organizations that may ask you for a letter verifying your pension income — maybe for housing or as part of an application for the Home Energy Assistance Program (HEAP). You can use Retirement Online to save or print your own letter any time you need one.

Manage Your Direct Deposit

Use Retirement Online to securely update your direct deposit bank account information. Whether you’ve switched banks or need to move your deposits to a different account, you can make those changes quickly with Retirement Online. Changes are generally applied within one to two payments, and more quickly than if you send in a paper form.

View Your Pension Pay Stubs

You can access pay stubs for your benefit payments by clicking the date of the payment you want to view. You can track year-to-date totals and any deductions for health insurance, union dues, tax withholding or disbursements under a domestic relations order, giving you greater insight into your benefits. NYSLRS will also send you a notice whenever the amount of your monthly payment changes.

Update Your Contact Information

Let us know if you move or your phone number or email address change. Update your contact information quickly in Retirement Online to make sure you continue to receive important news and information about your benefits.

You can even schedule an address change, so you’ll get NYSLRS mail at your seasonal home without interruption.

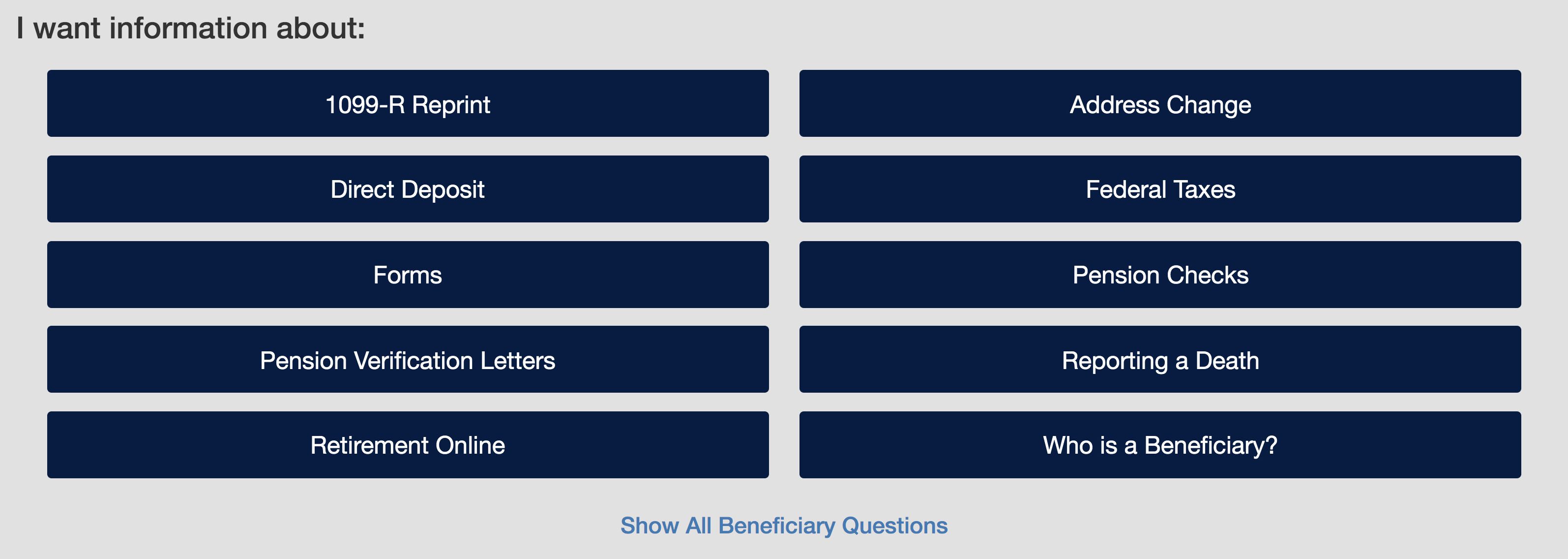

Manage Your Beneficiaries

Eligible retirees can change their beneficiary for their post-retirement death benefit or update contact information for an existing beneficiary.

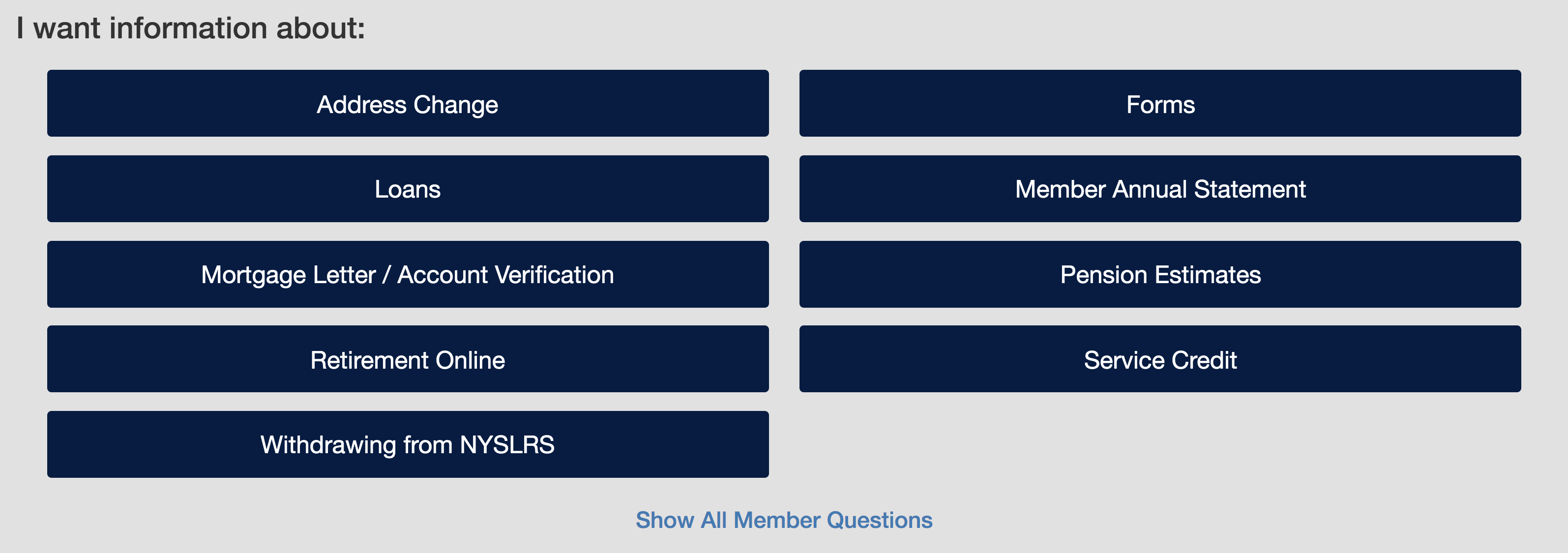

If You Haven’t Opened Your Account, Sign Up Today

If you don’t have a Retirement Online account, now is a great time to sign up. Click “Sign Up” on our Retirement Online Sign In page to get started. We have step-by-step instructions on registering for your account and how to sign in for the first time. If it’s been a while, you may need to look up your user ID or reset your password.

You may also find our Retirement Online Tools and Tips blog post helpful.