As a NYSLRS member, you may be making or have made contributions as part of your membership. When you make contributions, a percentage of your salary joins a pool of money called the Common Retirement Fund (the Fund). The Fund is also made up of employer contributions and investment income. By investing contributions, the Fund helps to meet its obligation of paying out benefits to past, present and future retirees.

What this means for you is that you, and other members like you, are all doing your part to fund your future retirement.

Types of Member Contributions

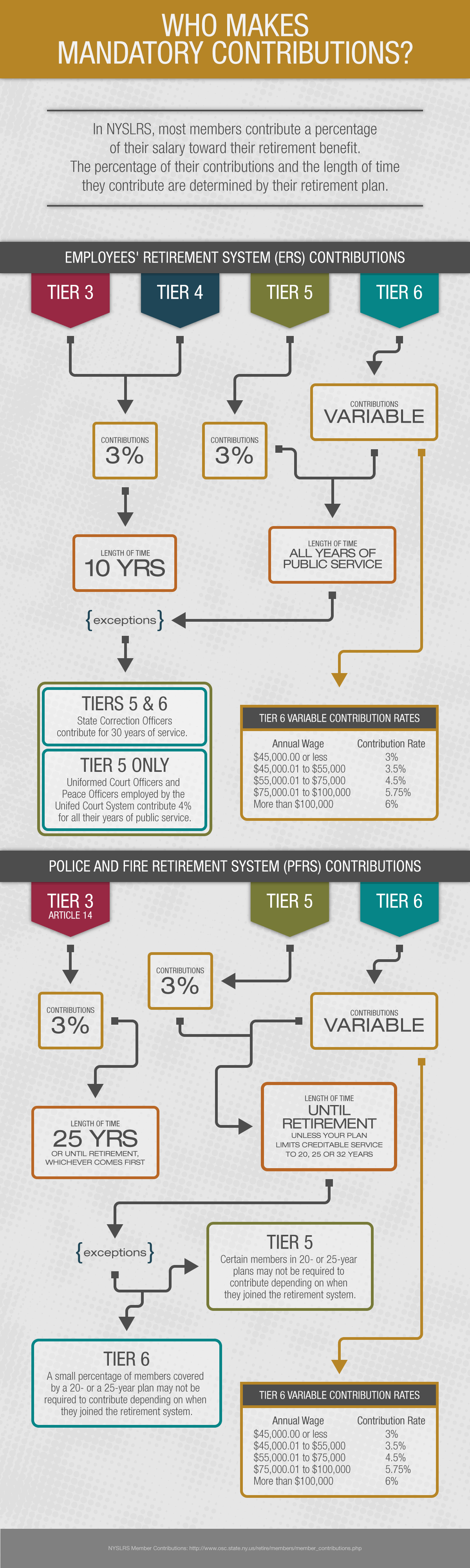

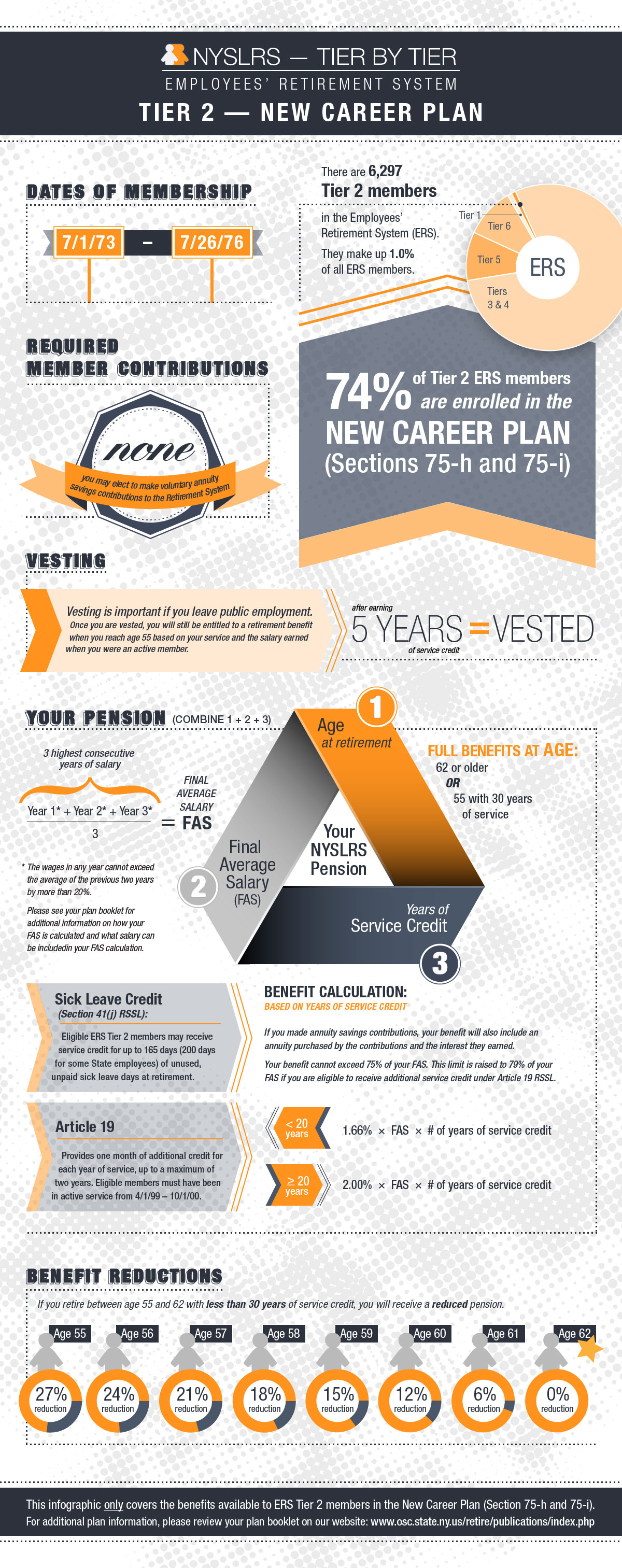

If you belong to a contributory retirement plan, you make required contributions. This means you must make contributions for the length of time listed in your retirement plan. Some members may contribute for only part or all their public service careers. If you belong to a non-contributory plan, this means you aren’t required to make contributions. Instead, you could make voluntary contributions over the course of your career, if your plan allows it. This would provide you with an annuity in addition to your pension when you retire.

(Check out the “Contributing Toward Your Retirement” section in your specific retirement plan publication to see what contributions you make.)

Withdrawing Your Member Contributions

What happens to your contributions if you leave public employment? One option is to take your contributions with you. If you have less than ten years of service credit or aren’t vested, you can withdraw your contributions plus the interest they’ve earned. However, withdrawing your contributions also terminates your membership with NYSLRS. Once your membership ends, you won’t be eligible for a retirement benefit.

Another option is to leave your contributions where they are. After all, if you leave public employment, there’s a chance you may return as well. If you do, then your contributions will be waiting for you when you rejoin NYSLRS. If you don’t return to public service, aren’t vested, and have been off the public payroll for seven years, by law we must terminate your membership. Any contributions left will stop accruing interest.

If you have ten or more years of service credit, you can’t withdraw your contributions from NYSLRS. In that situation, if you’re vested before you leave public employment, you can apply for a retirement benefit at a later date (age 55 for most members).

(Read our publication “What If I Leave Public Employment?” for more information, particularly the taxability of withdrawing your contributions.)

If you have questions, visit our website to learn more about member contributions. Want to read more NYSLRS Basics? Check out our earlier posts on:

If you’re an ERS Tier 2 member in an alternate plan, you can find your retirement plan publication below for more detailed information about your benefits:

If you’re an ERS Tier 2 member in an alternate plan, you can find your retirement plan publication below for more detailed information about your benefits: