When should you start saving for retirement? If you aren’t saving already, right now is the best time to start. If your retirement is a long way off, that means you’ll have more time for your savings to grow. But even if you’re close to retirement, it is never too late to start saving.

Why Save for Retirement?

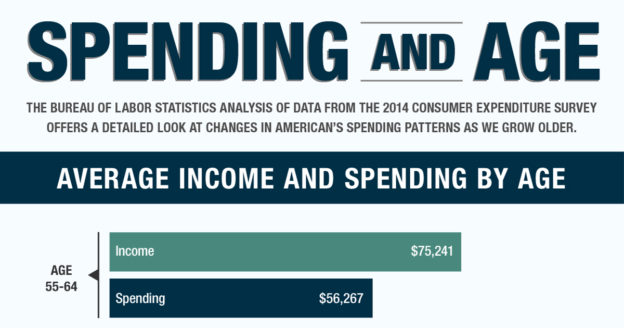

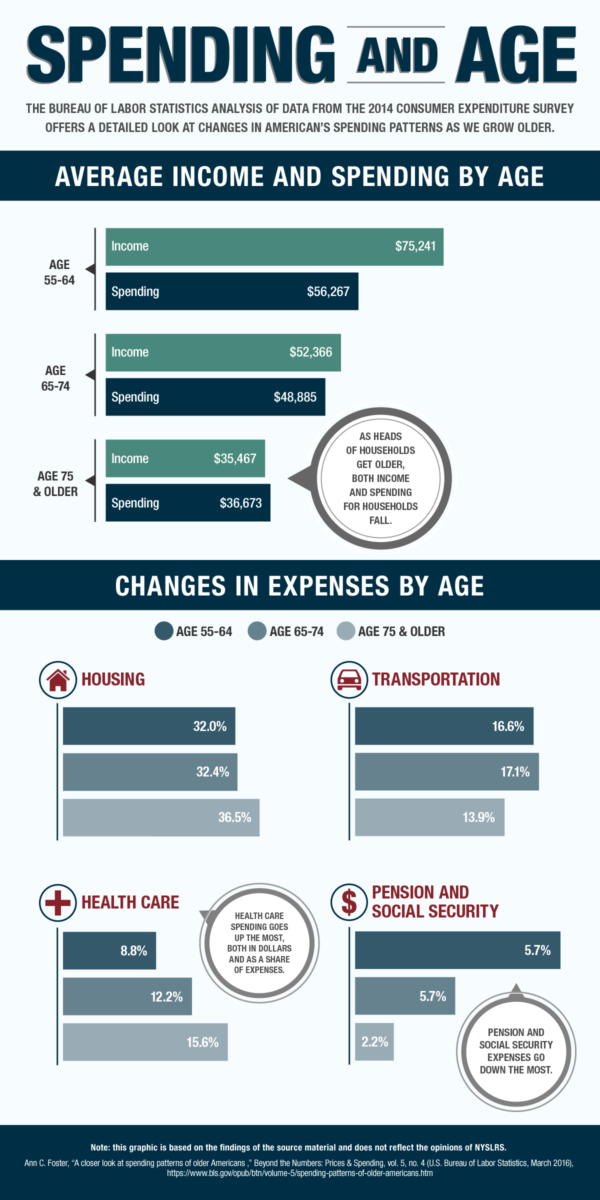

While retirees tend to spend less than they did while they were working, financial experts say you’ll still need 70 to 80 percent of your pre-retirement income to maintain your lifestyle during retirement.

NYSLRS members have the rare advantage of a well-funded, defined-benefit pension. As a NYSLRS member, once you’re vested, you’re entitled to a pension that, once you retire, will provide you with monthly payments for the rest of your life. Retirement savings can supplement your NYSLRS pension and Social Security, helping you reach that income-replacement goal.

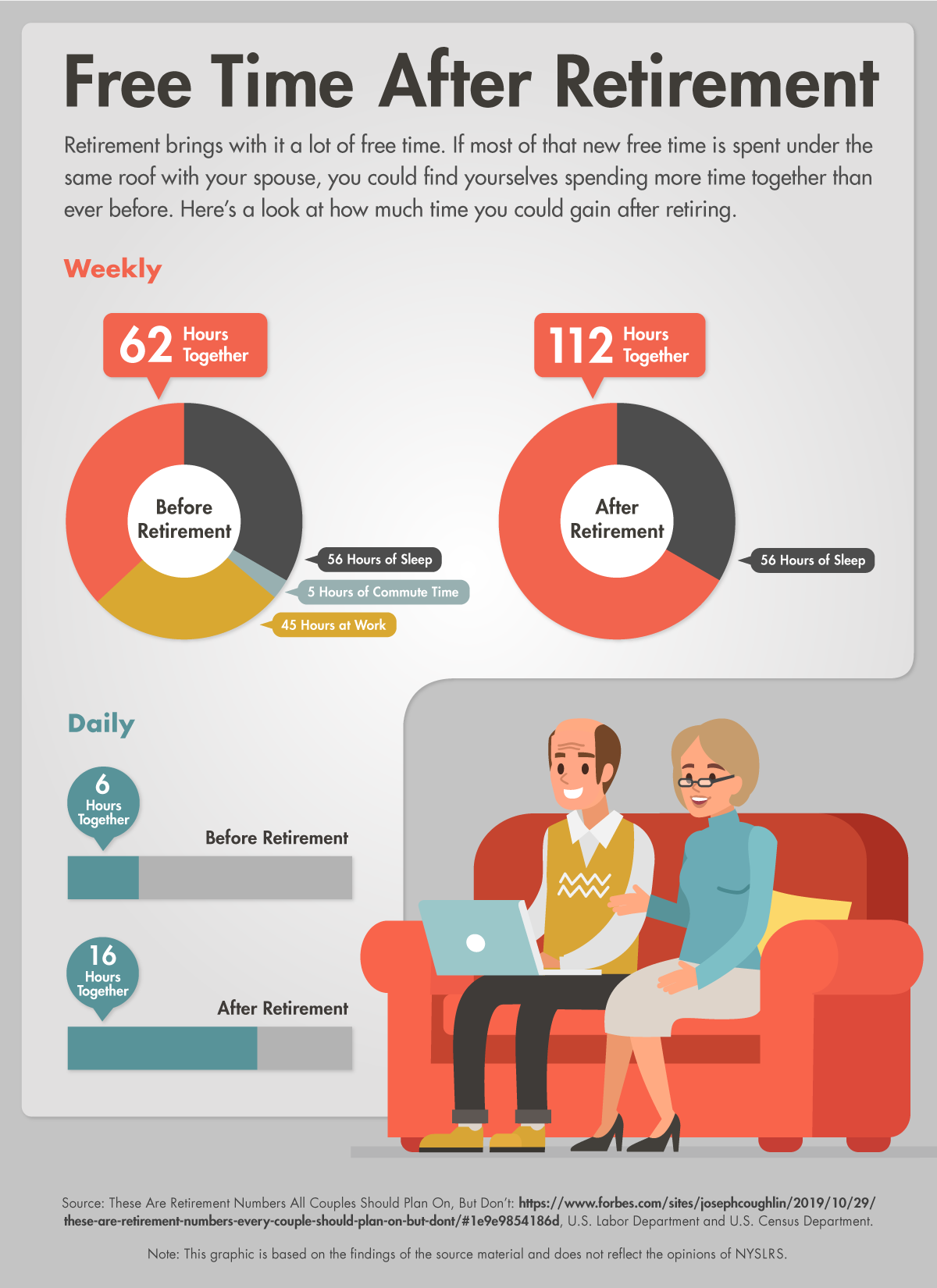

Retirement savings can also be a hedge against inflation and a source of cash in an emergency. A healthy retirement account will give you more flexibility during retirement, helping ensure that you’ll be able to do the things you want to do. It can also provide peace of mind.

Getting Started

For New York State employees and many other NYSLRS members, there’s an easy way to get started. If you work for a participating employer, you can join the New York State Deferred Compensation Plan. If you don’t work for New York State, check with your employer to see if you are eligible. If you are not eligible, your employer may be able to direct you to an alternative retirement savings program.

Once you sign up for Deferred Compensation, your contributions will automatically be deducted from your paycheck and deposited into your account. You can choose from a variety of investment packages or choose your own investment strategy. (The Deferred Compensation Plan is not affiliated with NYSLRS.)

If you have tax-deferred retirement savings (such as certain 457(b) plans offered by NYS Deferred Comp), you will eventually have to start withdrawing that money. After you turn 70½, you’ll be subject to a federal law requiring that you withdraw a certain amount from your account each year. If you don’t make the required withdrawals, called

If you have tax-deferred retirement savings (such as certain 457(b) plans offered by NYS Deferred Comp), you will eventually have to start withdrawing that money. After you turn 70½, you’ll be subject to a federal law requiring that you withdraw a certain amount from your account each year. If you don’t make the required withdrawals, called