Your plan publication is an essential resource that you should consult throughout your career. It will help you plan for retirement and guide you when your retirement date draws near.

Reminder: you can use this tool to help you find your retirement plan publication.

Let’s explore the information you’ll find in your plan publication and what it means.

About Your Membership

This section has basic information about your membership, including your tier, contributions, when you will be eligible for a pension and how to withdraw your membership if you leave public employment.

Service Credit

Service credit is one of the main factors in determining your pension benefit amount. If you work full-time for the State or a participating municipal employer for 12 months, you’ll earn a year of service credit. If you work part-time, your service credit is prorated.

You’ll also find information about how your service credit is calculated, how to purchase credit for previous public employment or military service, how leaves of absence affect service credit, and how sick leave can be used for extra service credit at retirement.

Final Average Earnings

Final average earnings (FAE) are another major factor in determining the amount of your pension. Your FAE is the average earnings during the set of consecutive years (three or five years, depending on your tier and retirement plan) when your earnings were highest.

This section describes what types of payments are used in calculating your FAE and any limitations that may apply.

Service Retirement Benefits

This section describes your retirement eligibility and how your benefit is calculated. If you have questions about how much your pension will be, you should read this section.

Choosing a Pension Payment Option

You can choose from several options for the payment of your pension. Some payment options allow you to provide for your spouse or other beneficiary after you die in exchange for a reduction in your monthly payment. Consider each payment option carefully, as you’ll only have at most 30 days to change it after you retire.

Items That May Affect Your Pension

This section describes factors that can change the amount of your pension. For example, if you retire with an outstanding loan, your pension will be permanently reduced. Also, if you get a divorce, your ex-spouse may be entitled to a portion of your benefit.

A cost-of-living adjustment (COLA), on the other hand, would increase your benefit once you become eligible.

Vested Retirement Benefits

If you leave public employment before retirement age but have met the minimum service requirement to receive a pension, you can apply for a vested retirement benefit when you become eligible.

Disability and Death Benefits

Your NYSLRS benefits include more than a pension. If you are no longer able to perform your job because of a medical condition, you may be eligible for a disability retirement. If you die before retirement, your survivors may be eligible for a death benefit.

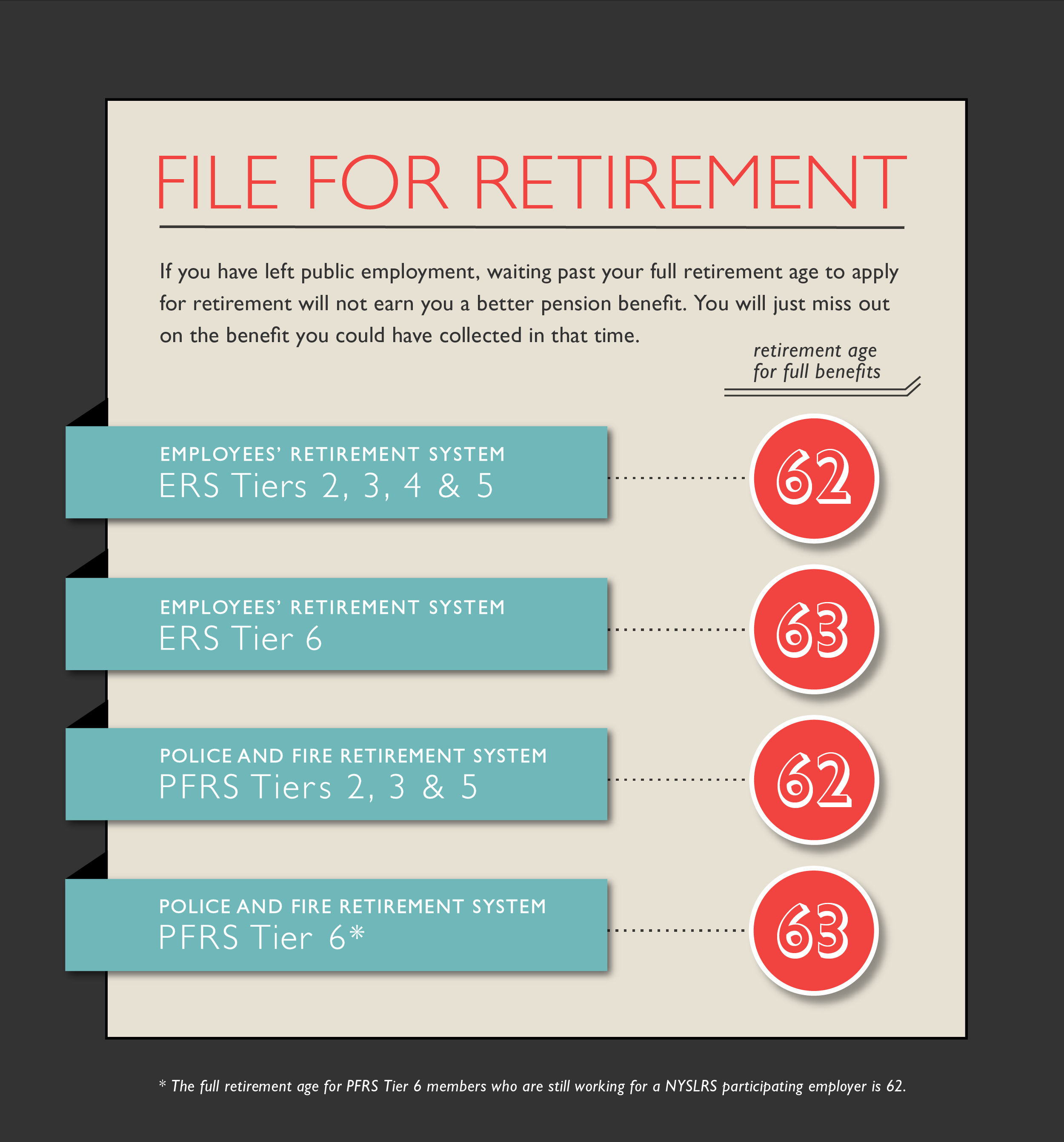

Receiving Your Benefits

Before you can receive your pension, you must file an application with the Office of the State Comptroller. This section describes the process of applying for your retirement benefits, including information about filing online.