Your NYSLRS pension will provide you with a monthly benefit for the rest of your life. When you apply for retirement, you’ll have the option to choose the maximum amount payable or a reduced benefit in exchange for possibly continuing payments to a beneficiary upon your death. In this post, we’ll explore the Joint Allowance and Pop-Up/Joint Allowance pension payment options which provide a lifetime benefit for a single beneficiary.

Joint Allowance Pension Payment Options

In exchange for a permanent reduction in your monthly pension payment, the Joint Allowance options provide a lifetime benefit to a beneficiary after you die.

You can select either:

- Full: Your beneficiary will receive the same monthly pension payment as you were receiving for life.

- Half: Your beneficiary will receive half of the monthly pension payment you were receiving for life.

- Partial: Your beneficiary will receive either 75, 50, or 25 percent of the monthly pension payment you were receiving for life.

You can only choose one beneficiary under a Joint Allowance option, and you cannot change your beneficiary after you retire—regardless of the circumstances. If your beneficiary dies before you, all payments will stop when you die.

Pension payment amounts are based on the birth dates of both you and your beneficiary. Because life expectancy is a factor, the reduction to your pension payment amount will be more if you select a child or grandchild than a spouse of a similar age as you.

If you designate your spouse as your beneficiary, they would be eligible to receive 50% of your cost-of-living adjustment.

Pop-Up/Joint Allowance Pension Payment Options

The Pop-Up/Joint Allowance options have all the same terms of the Joint Allowance options with added security—if your beneficiary dies before you, your monthly pension payment will “pop up” or increase to the amount you would have been receiving had you chosen the Single Life Allowance option at retirement. (Note: This only affects future payments. You would not be entitled to retroactive payments.) Therefore, the Pop-up/Joint Allowance options reduce your monthly pension payment a little more than a comparable Joint Allowance option.

Other Pension Payment Options

The Single Life Allowance provides the maximum monthly pension payment to you for the rest of your life. However, this option does not provide a continuing benefit. All payments will stop when you die, and nothing will be paid to a beneficiary.

Some pension payment options provide a limited benefit for multiple beneficiaries.

Things to Consider

When choosing your pension payment option, you may want to consider both your spouse’s and your:

- Financial needs (for instance, whether you have a mortgage, unpaid loans or other monthly payments).

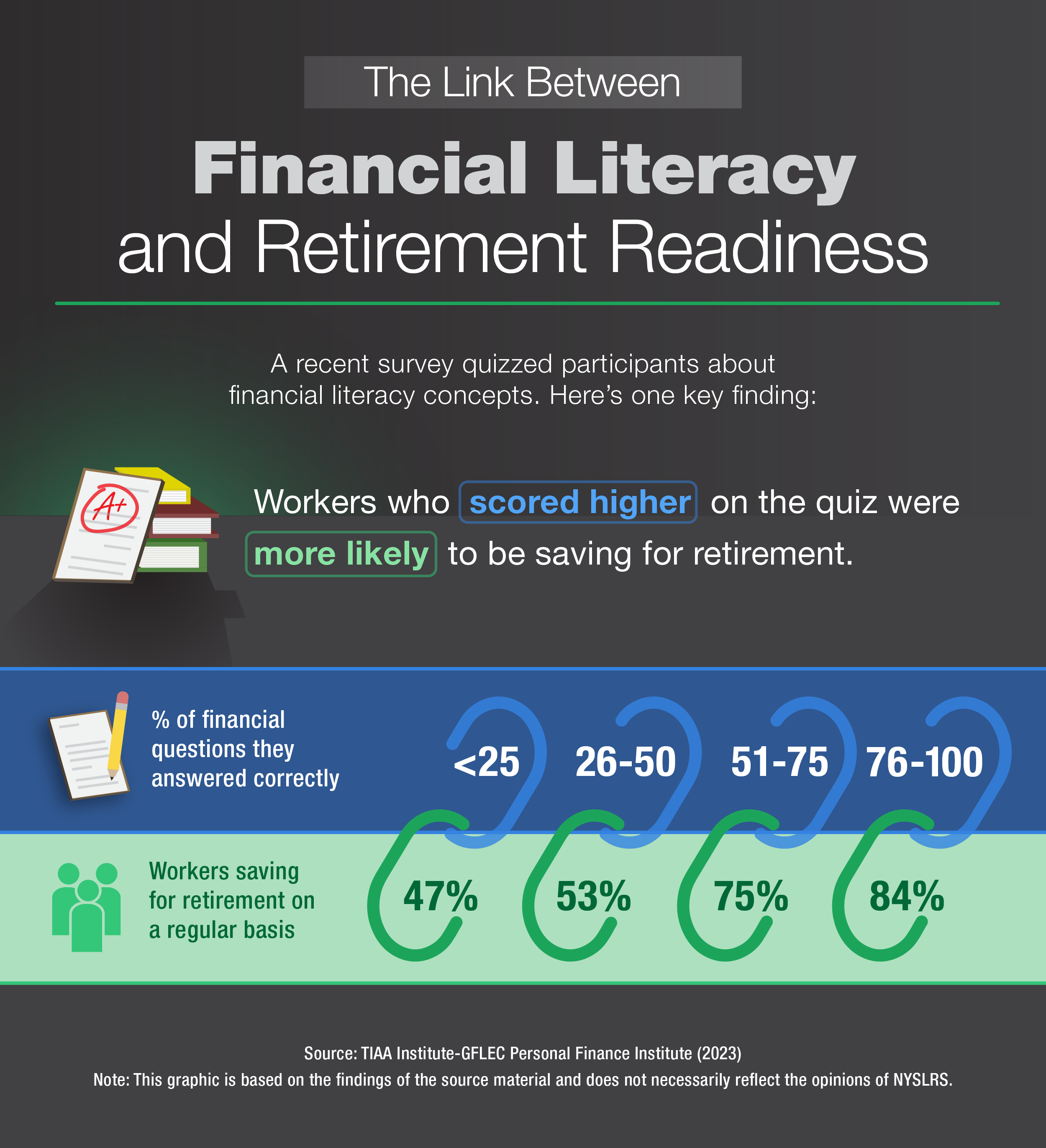

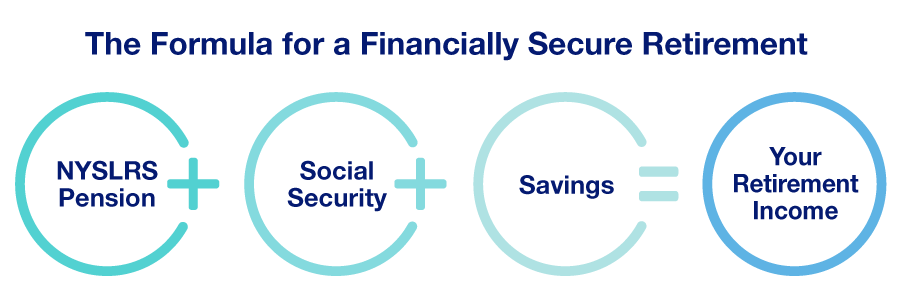

- Other sources of retirement income (for example, Social Security or savings).

- Options for continuing benefits (for example, whether your retirement plan includes a death benefit or if you have life insurance).

- Age and health at retirement.

You only have 30 days after the last day of your retirement month to change your option. After that date, you cannot change your option for any reason.

Estimate Your Pension in Retirement Online

Most members can use Retirement Online to create a pension estimate based on the most up-to-date salary and service information we have on file. You can enter different retirement dates, beneficiaries and pension payment options to see how they affect your potential benefit.

- Sign in to Retirement Online.

- Look under My Account Summary section.

- Click Estimate my Pension Benefit button.

When you’re done, print your pension estimate or save it for future reference.