If you retire from public employment in New York State and later decide to go back to work in the public sector, you have the option of rejoining NYSLRS. However, if you are considering rejoining the Retirement System, you should understand how rejoining would affect your pension benefits.

Rejoining NYSLRS may increase your total service credit, allowing you to reach certain milestones that would increase your pension. An increase in earnings could also result in a higher pension. However, depending how long you work after rejoining, your new pension may not be higher than your original amount.

Note: This post applies to service retirees of the Employees’ Retirement System (ERS) or the Police and Fire Retirement System (PFRS) who are rejoining the same system. Different rules may apply to retirees of other retirement systems, retirees joining a system other than the one they retired from, and disability retirees.

What Happens to Your Pension When You Rejoin NYSLRS?

If you rejoin NYSLRS, your pension will be suspended. If you are in Tiers 2 through 6 and you earn less than two years of new service credit after you rejoin, your original pension would be reinstated when you retire the second time. Any new service credit and earnings would not affect your pension. (Tier 1 members would receive an additional benefit even if they earn less than two years of service in their new membership.)

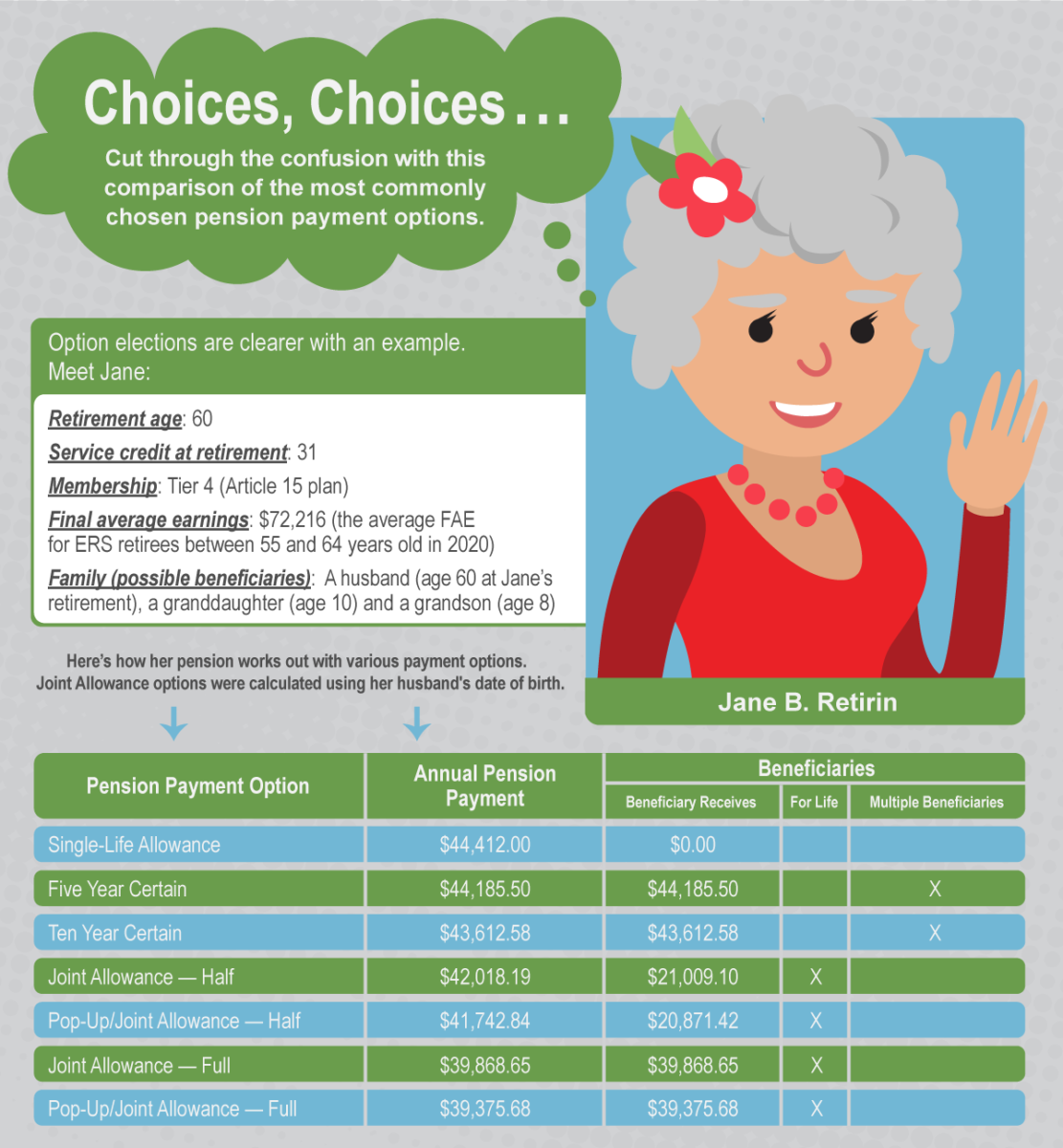

If you earn two or more years of new service, you can either receive your original pension or you can receive a recalculated benefit that includes your additional service. If you choose the recalculated benefit, you will have to repay the entire pension amount you have already received, plus interest. (The pension amount you repay would be based on the Single Life Allowance rate.) You may repay that amount in a lump sum or by installments before you retire again — or request a permanent reduction to your new pension.

Other Factors

Here are other things to consider before you rejoin NYSLRS:

- When you retire again, your new retirement date can delay your eligibility for the annual cost-of-living adjustment (COLA).

- If you are in Tier 1 or 2, rejoining may affect your death benefit.

Where to Go for Help

If you are considering rejoining NYSLRS, we strongly recommend you speak with a customer service representative to discuss how rejoining would affect your benefits. You can call them at 866-805-0990 or send them a message using our secure contact form.

You may also wish to read our publication Life Changes: What If I Work After Retirement?

After months or years of retirement planning, you’re probably looking forward to the day when you

After months or years of retirement planning, you’re probably looking forward to the day when you