Your Retiree Annual Statement provides a year-end summary of your pension payments for the last calendar year, including the total amount you received and a breakdown of credits, deductions and taxes. It also gives you an explanation of the pension payment option you chose at retirement.

We mail printed Retiree Annual Statements by the end of February. However, we make Statements available in Retirement Online sooner than printed copies are mailed—and you can sign in to your account now to access yours.

Reminder for members: Make sure you receive your Member Annual Statement, which is distributed beginning in May.

Get Your Statement Online Now

To view, save or print your Statement:

- Sign in to Retirement Online.

- Look under My Account Summary.

- Click View My Retiree Annual Statement button.

- If Retirement System is blank, click Look Up icon and select ERS or PFRS from dialog box.

- Click Look Up icon next to Calendar Year field and select an option from dialog box.

- Click Generate Statement.

The document will download on to your computer.

If you don’t have an account, check out our Retirement Online Tools and Tips blog post where you’ll find a link to step-by-step instructions to help you register for Retirement Online.

Understanding Your Retiree Annual Statement

Your annual Statement provides year-end benefit and payment information for the previous calendar year, including:

- Your total pension benefit amount before credits, deductions and taxes.

- Credits for adjustments or reimbursements, such as a cost-of-living adjustment (COLA) or Medicare reimbursements. (Only applicable credits appear in your Statement.)

- Deductions for recoveries, payments to an alternate payee, health insurance, or other dues or fees you’ve authorized to have deducted from your pension benefit. (Only applicable deductions appear in your Statement.)

- The amount withheld for federal taxes.

- Your total net benefit after credits, deductions and taxes.

If you have questions about the information and terms used in your Statement, check out our Guide to Your Statement for a short explanation of each.

Do Not Use Your Statement for Tax Purposes

While your Retiree Annual Statement includes pension payment and tax information, it is not a tax document. If your pension is taxable, we provide a 1099-R tax form (either through Retirement Online or by mail, depending on your delivery preference) for filing your taxes.

View Your Pension Pay Stub for Year-to-Date Information

Your pay stub gives you valuable insight into your monthly pension payment, including a breakdown of credits, deductions and taxes. Throughout the year, you can access your pay stubs online to see year-to-date totals.

- Sign in to Retirement Online.

- From Account Homepage, click View Pension Check link.

- Select date of the pension payment to view.

Get an Email Notification for Your Statement

Next year, you can get access to your Statement sooner by updating your delivery preference to email. When your Statement is available, we’ll send an email notifying you to sign in to Retirement Online.

- Sign in to Retirement Online.

- Look under My Profile Information.

- Click update next to ‘Retiree Annual Statement by.’

- Choose Email from dropdown.

Be sure the email address listed in your Retirement Online profile is current.

Note: If you choose email as your delivery preference, you will not receive a printed copy in the mail.

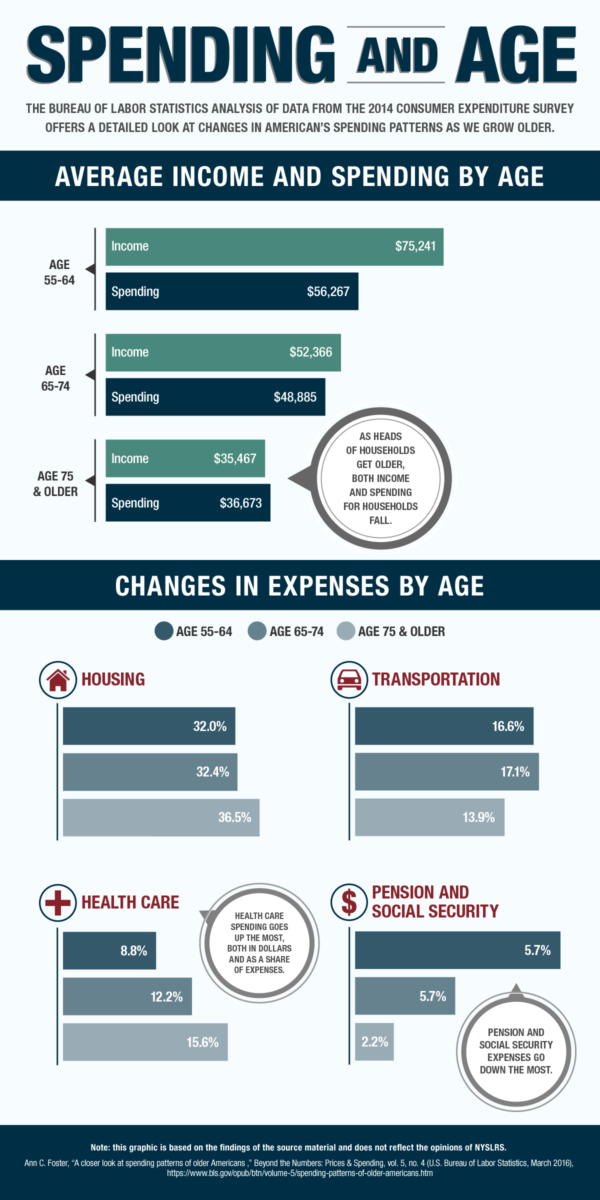

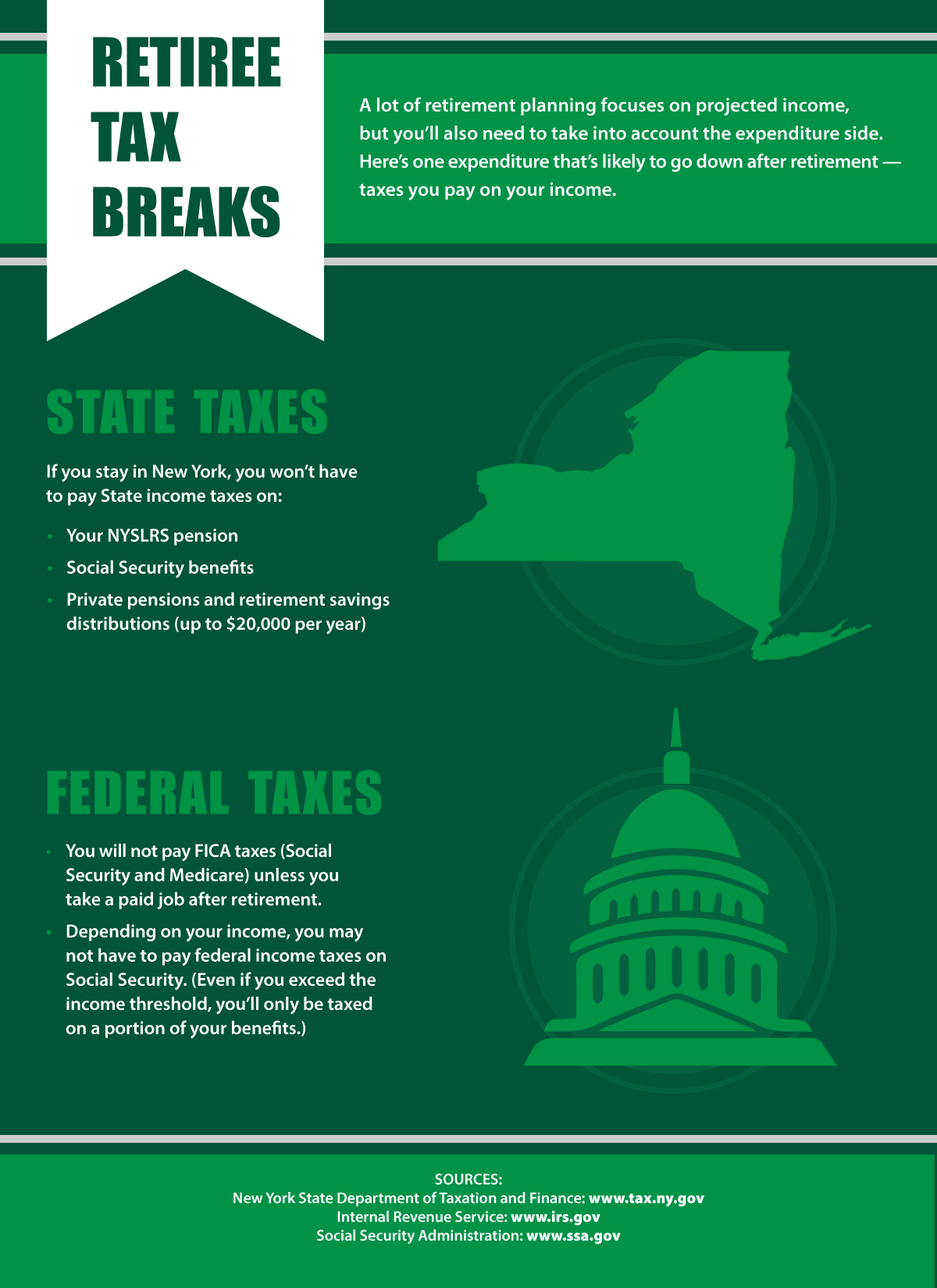

Tax season is here. While your NYSLRS pension is not subject to New York State or local income tax, most NYSLRS pensions are subject to federal income tax. Each year, we provide a 1099-R tax form with the information you need to file your taxes.

Tax season is here. While your NYSLRS pension is not subject to New York State or local income tax, most NYSLRS pensions are subject to federal income tax. Each year, we provide a 1099-R tax form with the information you need to file your taxes.

If you have tax-deferred retirement savings (such as certain 457(b) plans offered by NYS Deferred Comp), you will eventually have to start withdrawing that money. After you turn 70½, you’ll be subject to a federal law requiring that you withdraw a certain amount from your account each year. If you don’t make the required withdrawals, called

If you have tax-deferred retirement savings (such as certain 457(b) plans offered by NYS Deferred Comp), you will eventually have to start withdrawing that money. After you turn 70½, you’ll be subject to a federal law requiring that you withdraw a certain amount from your account each year. If you don’t make the required withdrawals, called