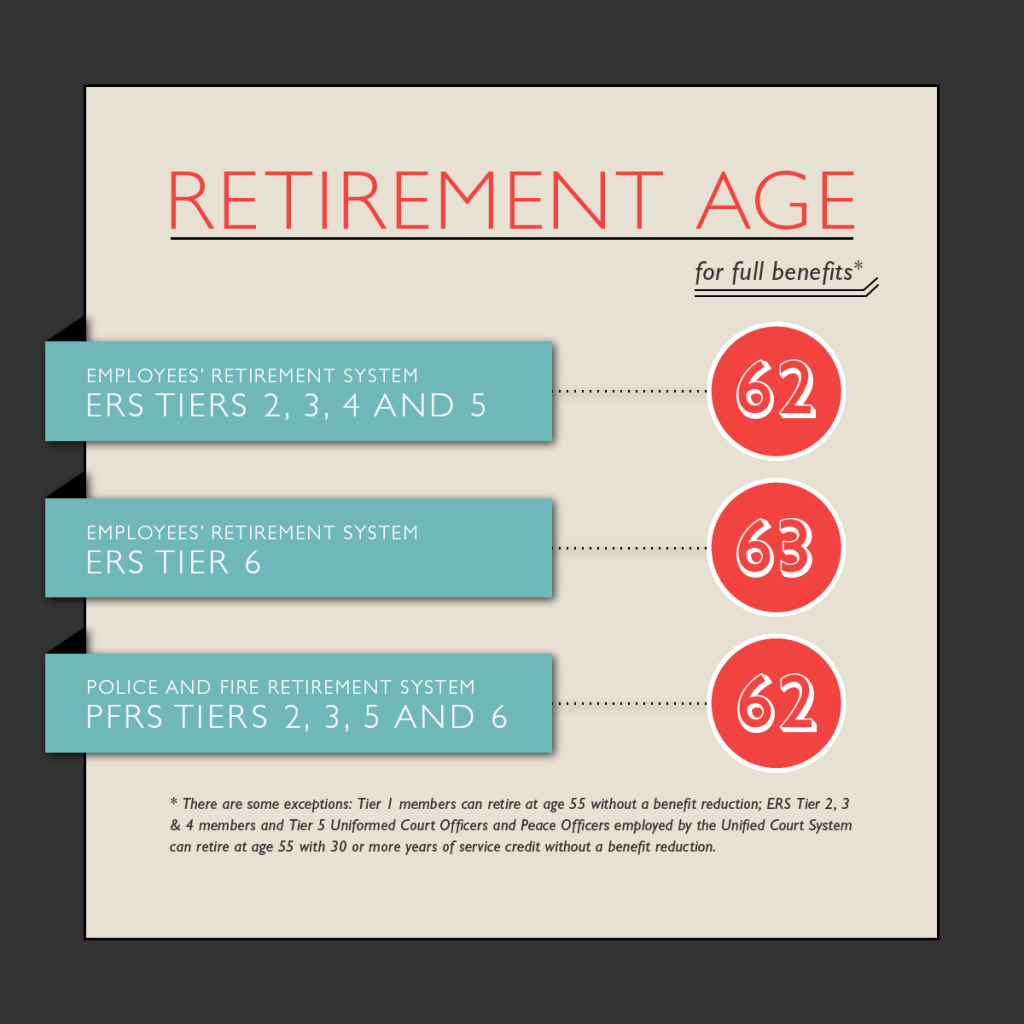

NYSLRS manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.

manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.

Special plans are a little different. With special plans, NYSLRS members can receive a pension after completing 20 or 25 years of service. There is no age requirement; you can retire at any age once you have the full amount of required service credit. Both ERS and the Police and Fire Retirement System (PFRS) have special plans.

Special Plans for Special Services to the State

As of March 31, 2018, seven percent of active ERS members and 98 percent of active PFRS members are in special plans. These members fill roles such as:

- Police officer;

- Firefighter;

- Correction officer;

- Sheriffs undersheriff, and deputy sheriff; and

- Security hospital treatment assistant.

Public employees in jobs like these face dangers and difficulties throughout their careers. They fight fires, patrol our neighborhoods, assist ill patients and more. We’d like to take this opportunity to thank them for the challenging, sometimes life-threatening work they do each day.

If you’d like to learn more about your retirement plan, please visit the Publications page of our website and review your plan publication. If you’re not sure which booklet covers your benefits, you can check your Member Annual Statement, ask your employer or send us an email using our secure contact form.

As public employees in New York State, elected and appointed officials are usually NYSLRS members. However, their compensation generally isn’t based on an hourly rate, and their irregular hours can make a typical timekeeping system impractical. So, how do we fairly and accurately credit their service in our system?

As public employees in New York State, elected and appointed officials are usually NYSLRS members. However, their compensation generally isn’t based on an hourly rate, and their irregular hours can make a typical timekeeping system impractical. So, how do we fairly and accurately credit their service in our system?