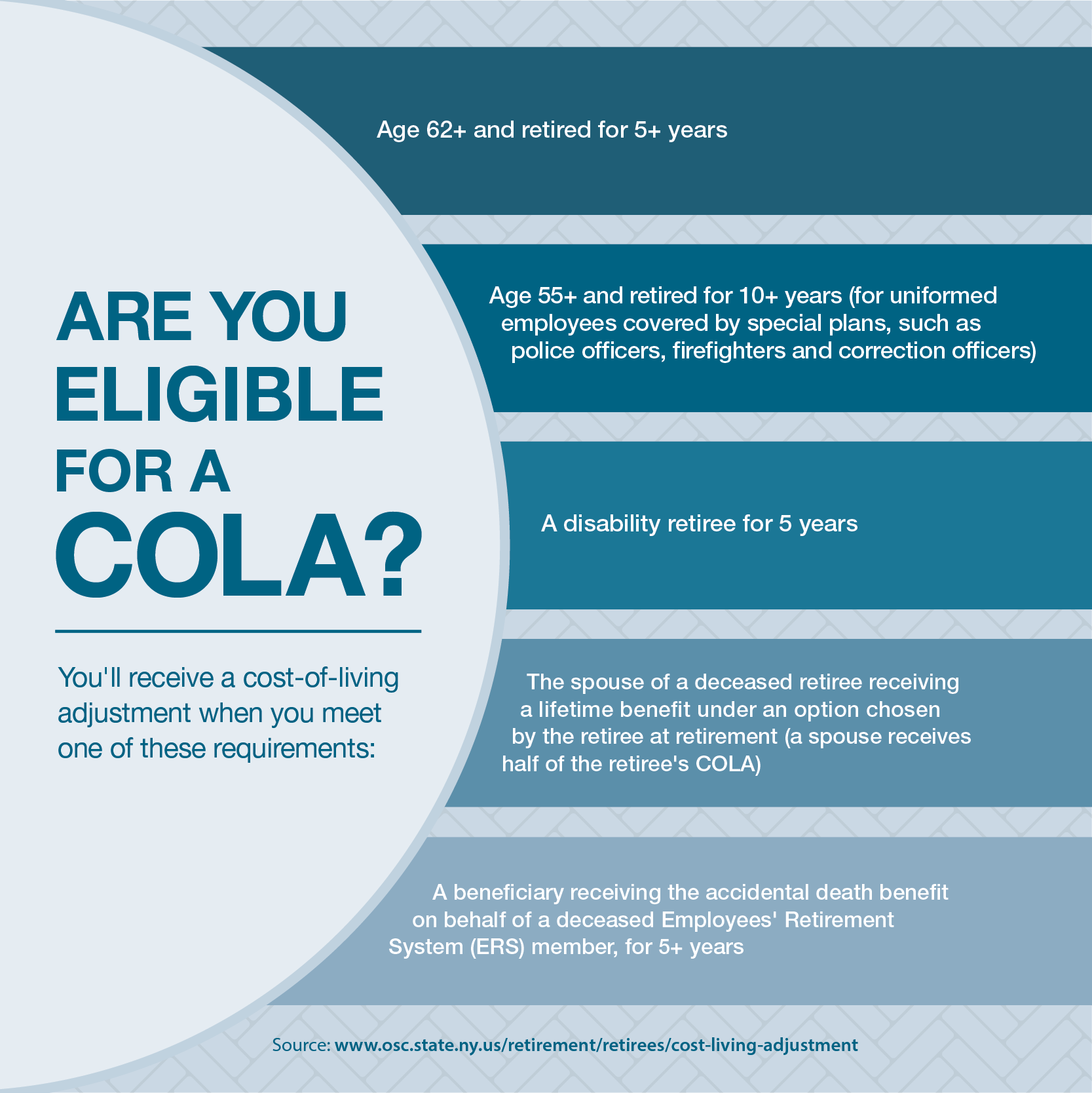

Eligible NYSLRS retirees will see a cost-of-living adjustment (COLA) in their monthly pension payments at the end of September 2023. This is a permanent annual increase to your retirement benefit that is based on the cost-of-living index and a formula set by State law. For upcoming pension payment dates, check our pension payment calendar.

How the COLA is Determined

The COLA is based on the rate of inflation, as reflected in the consumer price index published by the U.S. Bureau of Labor Statistics. The law requires that COLA payments be calculated based on 50 percent of the annual rate of inflation, as measured at the end of the State fiscal year (March 31). Once you are eligible, your annual increase will be at least 1 percent, but no more than 3 percent.

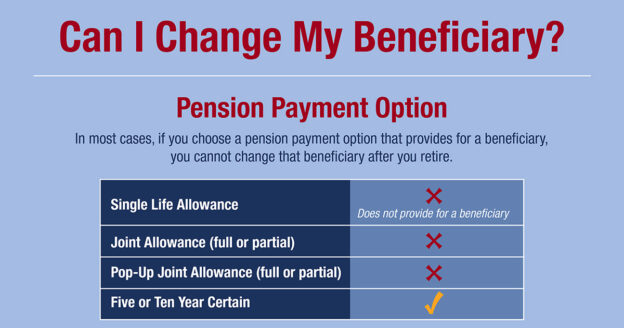

The percentage is applied to the first $18,000 of your benefit as if you had chosen the Single Life Allowance pension payment option, even if you selected a different option at retirement. Using the Single Life Allowance gives you the highest COLA amount possible, since this option pays the highest benefit. Once your COLA payments begin, you will automatically receive an increase to your monthly benefit each September.

The September 2023 COLA is 2.5 percent, for a maximum annual increase of $450.00, or $37.50 per month before taxes.

When Will You See the Increase?

Eligible retirees will see the annual 2023 COLA in their end-of-September pension payment, which will be available to those with direct deposit on September 29, 2023. If you receive a paper check, your COLA will be included in the check mailed on September 28, 2023.

Viewing Your Benefit Payment

You can view your benefit payment pay stubs, including your current COLA amount, in Retirement Online. At the end of September, if you are eligible for the increase, you’ll be able to view a breakdown of your September payment with your new COLA amount.

To view your pension payments, sign in to Retirement Online. From the top of your Account Homepage, in the ‘I want to’ section, click the “View Pension Check” link. Then select the date of the pension payment that you want to view. You’ll see a list of payments you received beginning with your January 2023 payment and going forward. If you have direct deposit, you will also receive a notification of the net change in your monthly payment amount at the end of September.