Striving to maintain a good credit score is just as important in retirement as it is during your working years. You may be retired, but financial necessities continue. You may need to get a car loan or refinance a mortgage, and good credit ensures you can borrow money at a decent interest rate. In fact, bad credit could prevent you from renting an apartment, or you may be required to pay higher insurance premiums. Fortunately, it seems maintaining good credit is just a matter of continuing what you’ve already been doing.

What is a Credit Score?

Your credit score is a three-digit number used by lenders to judge how likely you are to pay back money you’re loaned. It’s based on your past payment history and other interactions with lenders. These three digits affect you more than you might realize.

According to the Consumer Financial Protection Bureau (CFPB), “Companies use credit scores to make decisions on whether to offer you a mortgage, credit card, auto loan, and other credit products, as well as for tenant screening and insurance. They are also used to determine the interest rate and credit limit you receive.”

How to Maintain a Good Credit Score

The best way to maintain your credit score is to borrow responsibly and manage debt effectively. That means:

- Pay your bills on time. Pay more than the minimum payments if you can. Your payment history accounts for about a third of your credit score.

- Avoid using all or most of your available credit. The ratio of debt to available credit is another factor in your credit. If all your credit cards have balances near the limit, your credit score will suffer.

- Keep longstanding credit lines open. These accounts show your long history of being responsible with credit and help to boost your score.

- Don’t accumulate excessive debt. You especially want to avoid opening several lines of credit in a short amount of time.

Things like age and salary are not part of the credit score equation, so being retired does not hurt your score. However, lenders do take income into account when you apply for a loan, so you may find it harder to borrow after retirement, even if you have good credit.

Check Your Credit Reports Annually

Even if you’re doing everything right, misinformation in the files of credit rating companies could hurt your credit. So, check your credits scores regularly.

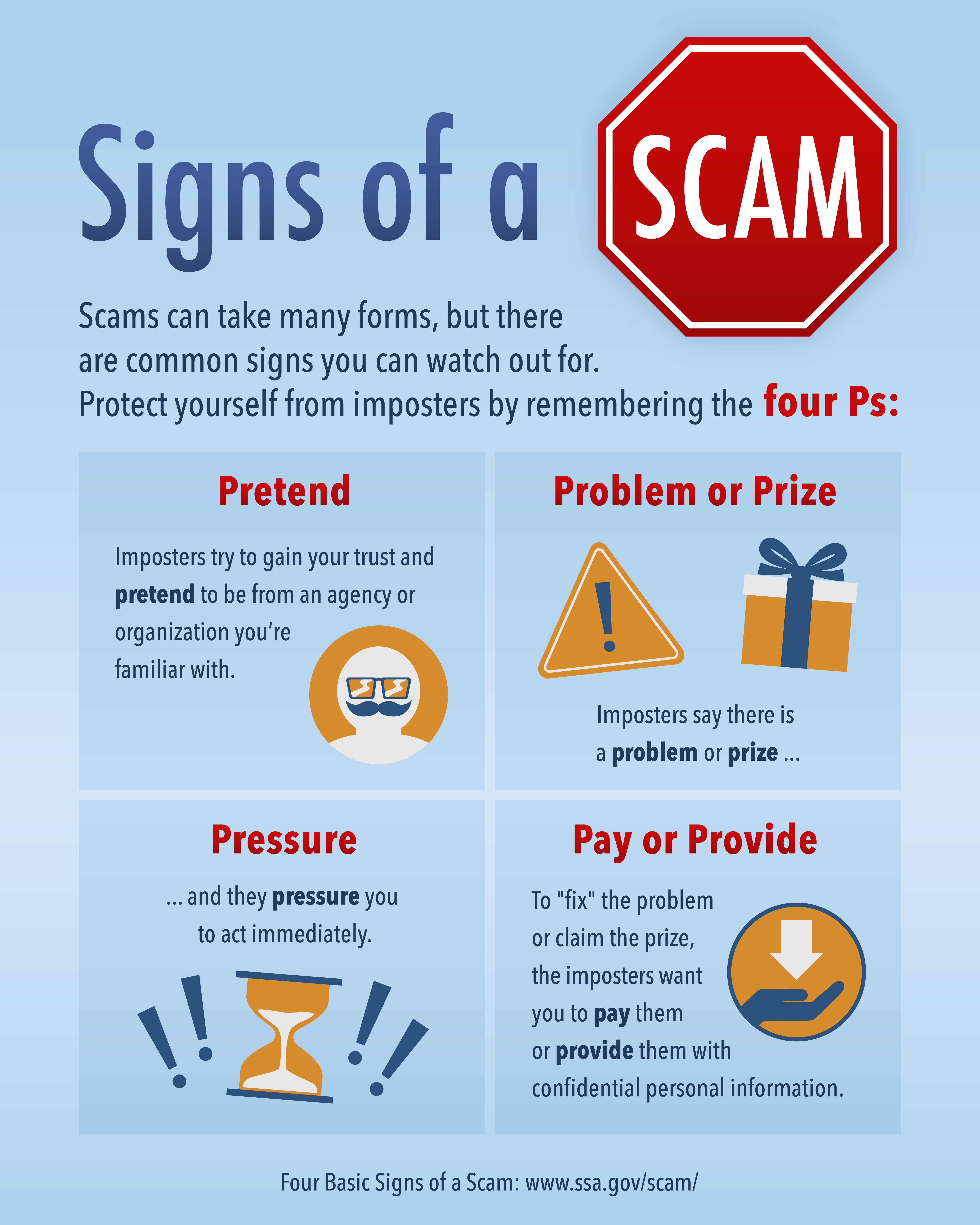

Under federal law, the three nationwide credit reporting companies are required to provide a free credit report once every 12 months. But you must request it. You can request your credit report online at AnnualCreditReport.com or by calling 877-322-8228. AnnualCreditReport.com is a website maintained by the three major credit reporting agencies—Equifax, Experian and TransUnion. It is the only free credit report site authorized by the federal government. Beware of impostor sites.