Thinking about retiring soon? Our Countdown to Retirement series will help you get started and stay on track to hit your retirement date.

Review Your Account Information in Retirement Online

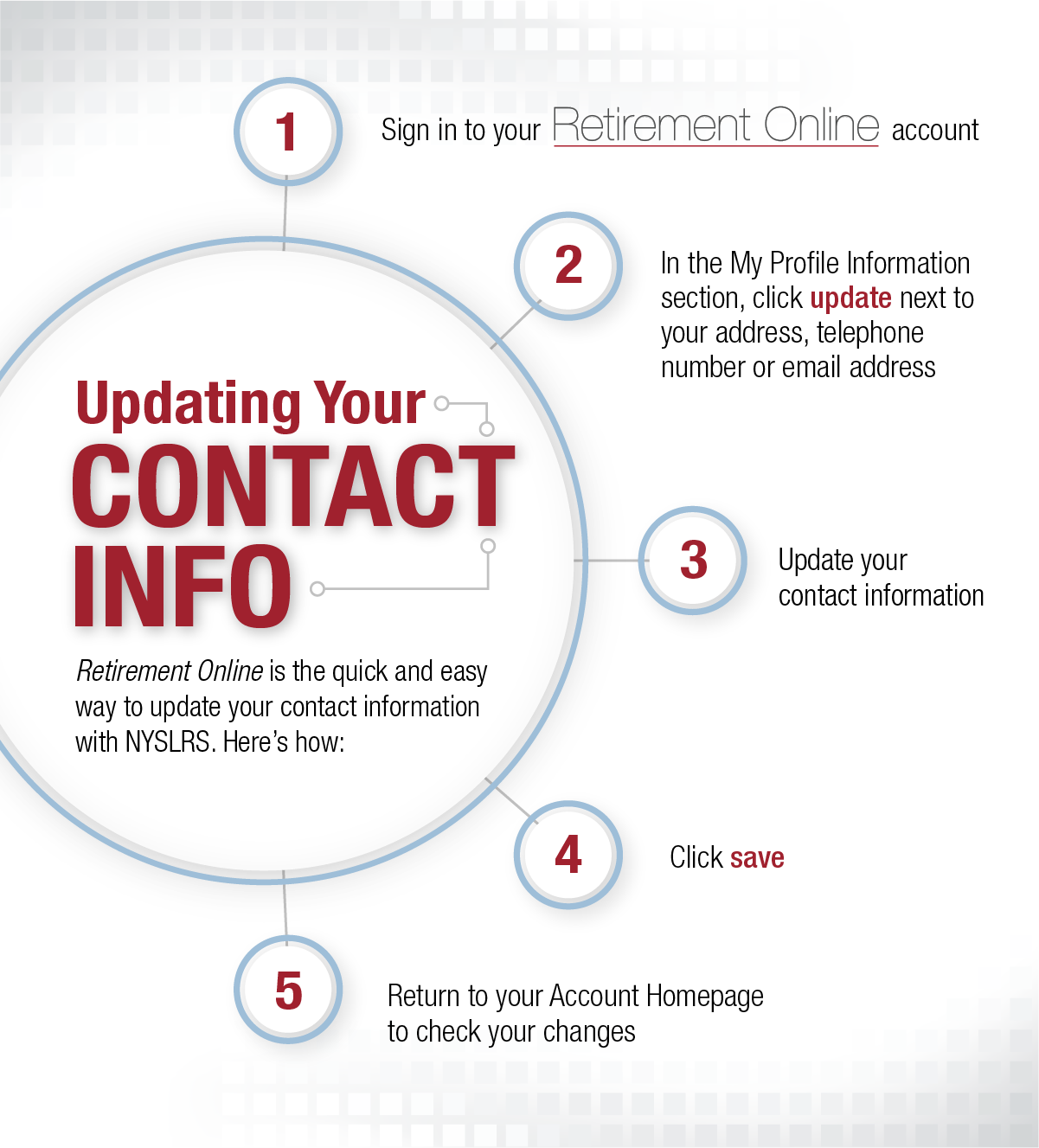

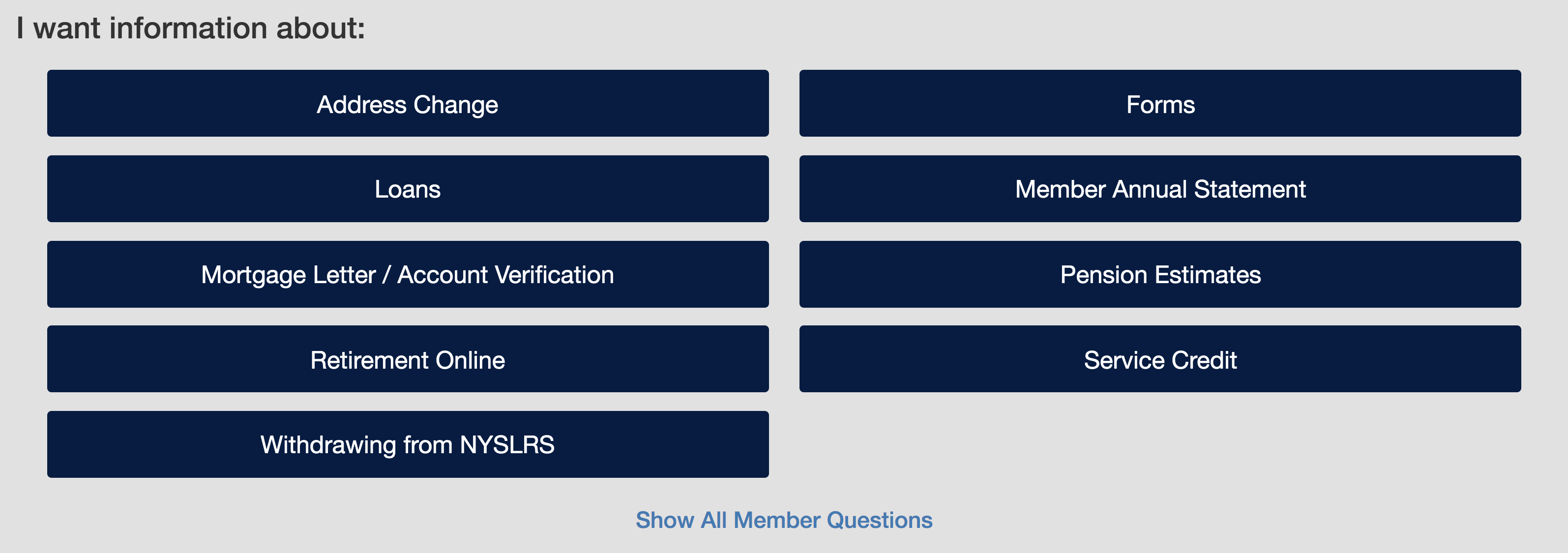

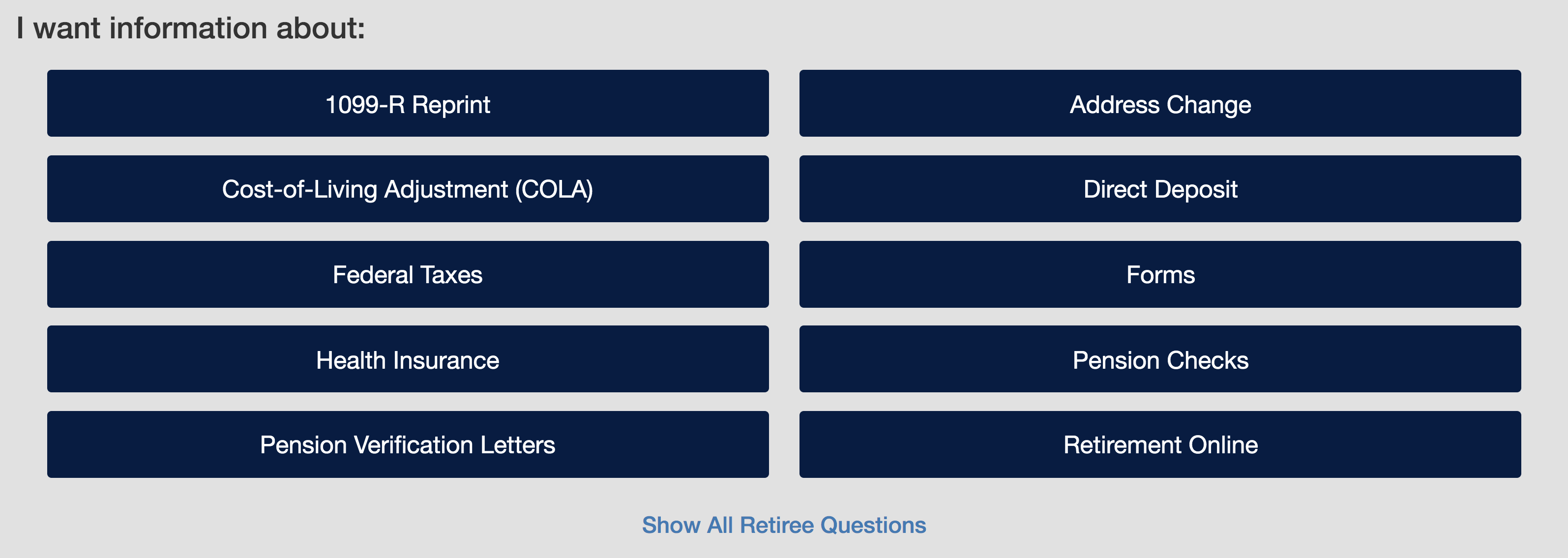

As your first step on the road to retirement, you should sign in to your Retirement Online account and review the information we have on file for you. If you don’t have an account, consider signing up for one. It’s an essential retirement tool that will make the retirement process easier.

Make sure your mailing address and email address are current and check other information in your account. In your Retirement Online account, you’ll find:

- The date you joined NYSLRS;

- Your tier and membership plan;

- Your estimated service credit;

- Your annual earnings for the past five years; and

- Loan balances and payoff dates.

If you believe information is missing or incorrect in your Retirement Online account, please contact us.

Read Your Retirement Plan Booklet

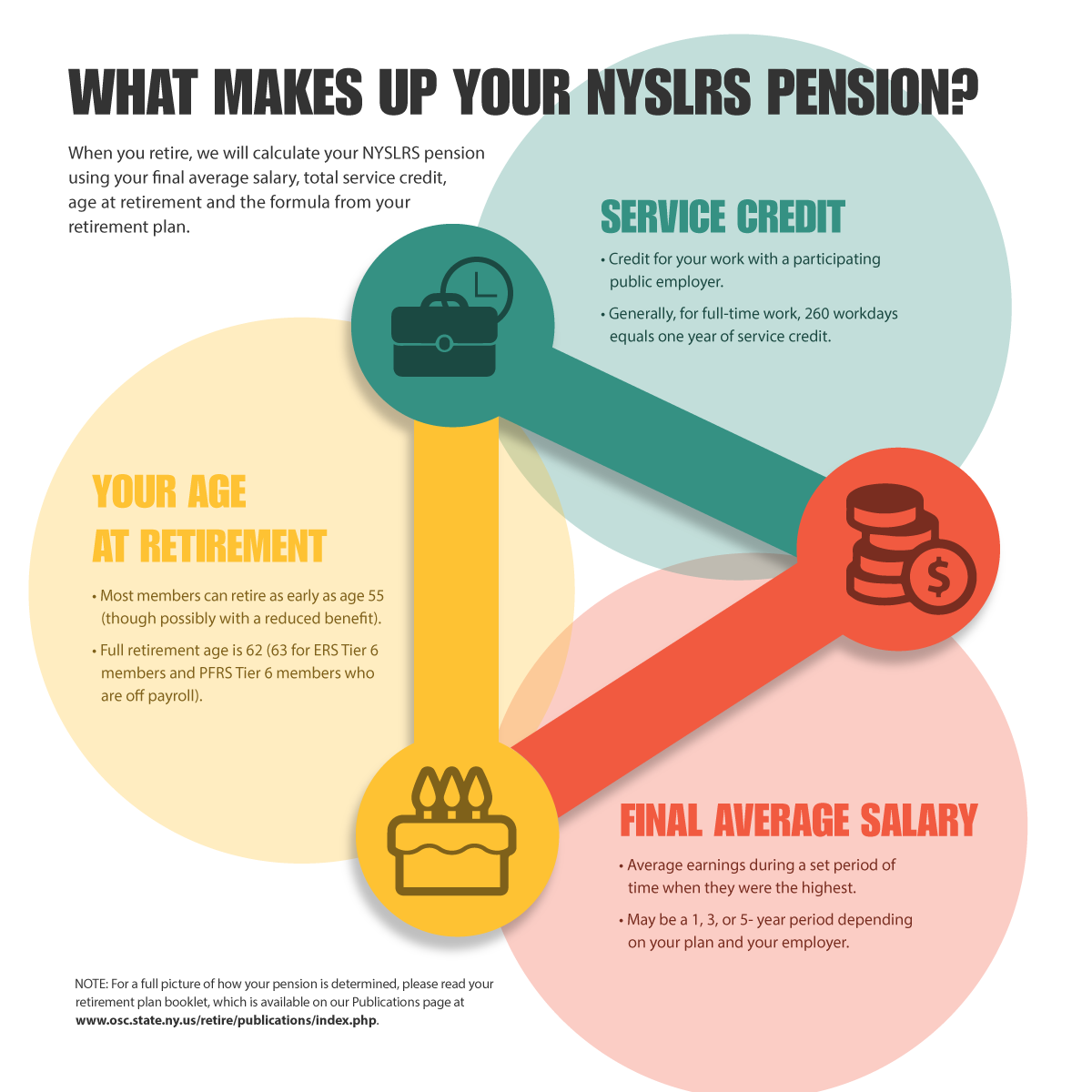

Your retirement plan booklet provides essential information about your NYSLRS benefits. It shows the formula that NYSLRS will use to calculate your pension and discusses other factors that may affect your pension.

You can find your plan booklet on our Publications page. Read our blog post about retirement plans to figure out which plan is yours. If you’re still not sure, check your Retirement Online account or ask your employer.

Learn How Divorce Can Affect Your Pension

If you’ve been through a divorce since you joined NYSLRS, that may affect your pension.

Retirement benefits are considered marital property and can be divided between you and your ex-spouse. Any division of your benefits must be stated in a domestic relations order (DRO), a legal document that gives us specific instructions on how your benefits should be divided.

Read our Divorce and Your Benefits page to learn more.

Other Things to Consider

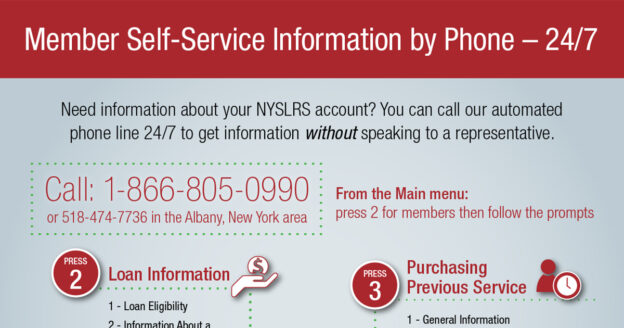

If you have a NYSLRS loan, you should plan to pay it off before retirement. Your pension will be reduced if you retire with an outstanding loan. You can use Retirement Online to check your balance, make a lump-sum payment or increase your payment amount. For more information, visit our Loans page.

If you are planning to purchase service credit, including military service, you should do that as soon as possible. You can apply for additional credit in Retirement Online or submit a Request to Purchase Service Credit form (RS5042). Our publication Service Credit for Tier 2 Through 6 has more information.

Your Countdown to Retirement

Your planned retirement date will be here before you know it. Watch for future posts in the Countdown to Retirement series for steps to take at 12 months, four-to-six months and one-to-three months before your retirement date.