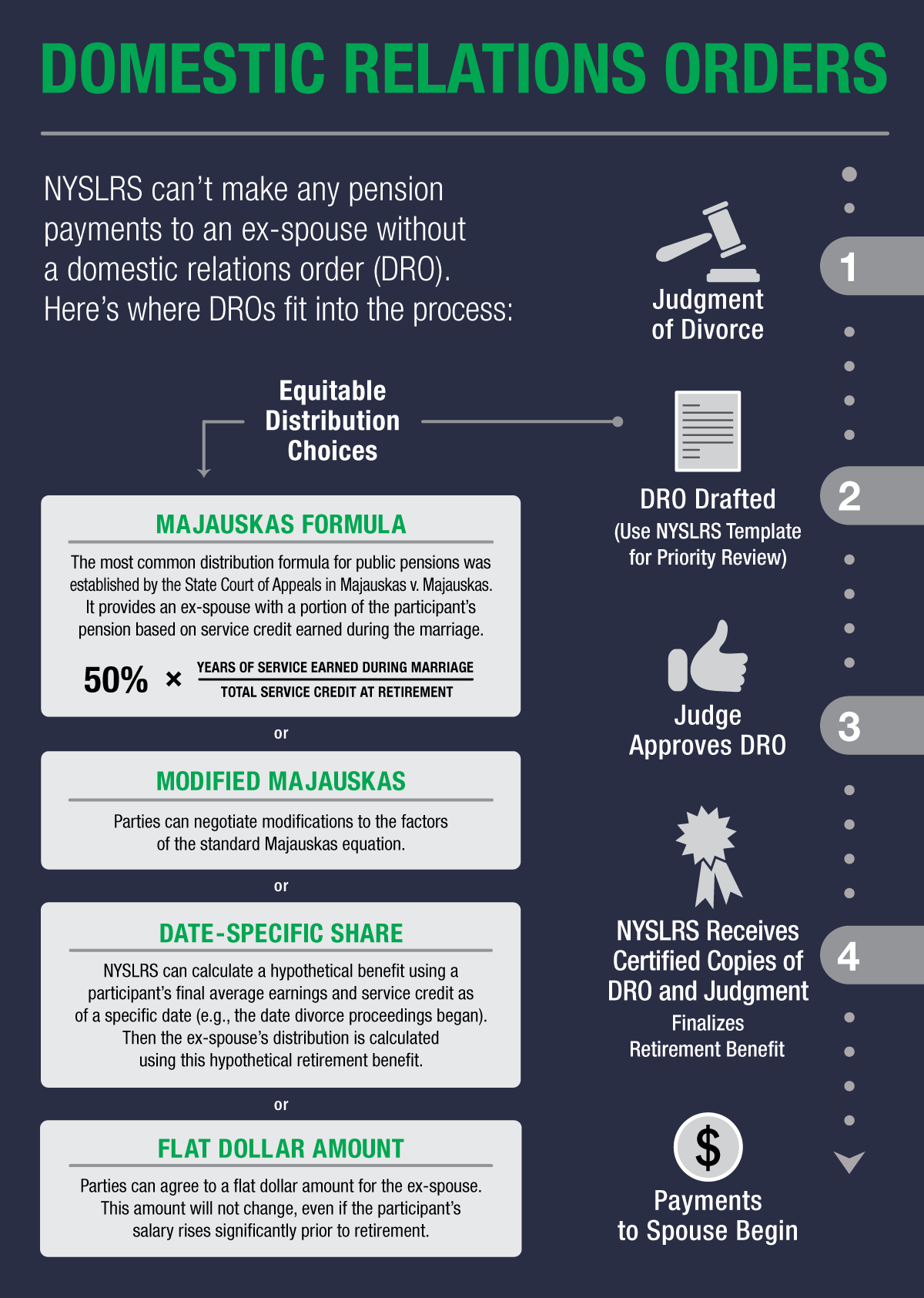

One aspect of retirement planning some members may not consider is how a divorce may affect their pension benefit. In New York State, retirement benefits earned by NYSLRS members are considered marital property. So, if you get a divorce, a judge may award your ex-spouse part of your pension. The process for dividing retirement assets after a divorce is complicated, but here is some basic information.

Dividing Pension Benefits After a Divorce

A commonly used formula for distributing pension benefits, established by the State Court of Appeals (the Majauskas formula), provides an ex-spouse with a portion of your pension based on half of the service credit you earned while you were married.

For example, let’s say you worked in your public-sector job for 10 years before you married. Then you got married continued working in public service for another 20 years, and then divorced. After the divorce, you continued working in public service for an additional 10 years. You’d have 40 total years of service credit, but only 20 years of your service was earned during your marriage. Under the Majauskas formula, your ex-spouse would be entitled to the proceeds of half of the service credit you earned during the marriage (10 years of service), or a quarter of your pension.

Other ways to divide pension benefits include a flat dollar amount, a benefit based on a specific date or a flat percentage of the benefit.

Domestic Relations Orders

To divide your retirement benefits after a divorce, NYSLRS needs a Domestic Relations Order (DRO). This court order, issued after a final judgment of divorce, gives us specific instructions on how your benefits should be split.

If your pension benefits will be affected by divorce, your DRO should be submitted to the Retirement System before you apply for retirement. We require a certified copy of the DRO, and it must be signed by a Supreme Court judge and entered as an official court document. We also require proof of divorce, such as a copy of the judgment of divorce. Failure to submit your DRO before you retire could result in a delay of your pension payments or an overpayment to you, which would need to be recovered by NYSLRS.

Learn More

Divorce may affect other NYSLRS benefits as well. Read Divorce and Your Benefits for more information including formulas for determining an ex-spouse’s share, a template you can use to draft a DRO and how to avoid a rejected DRO.