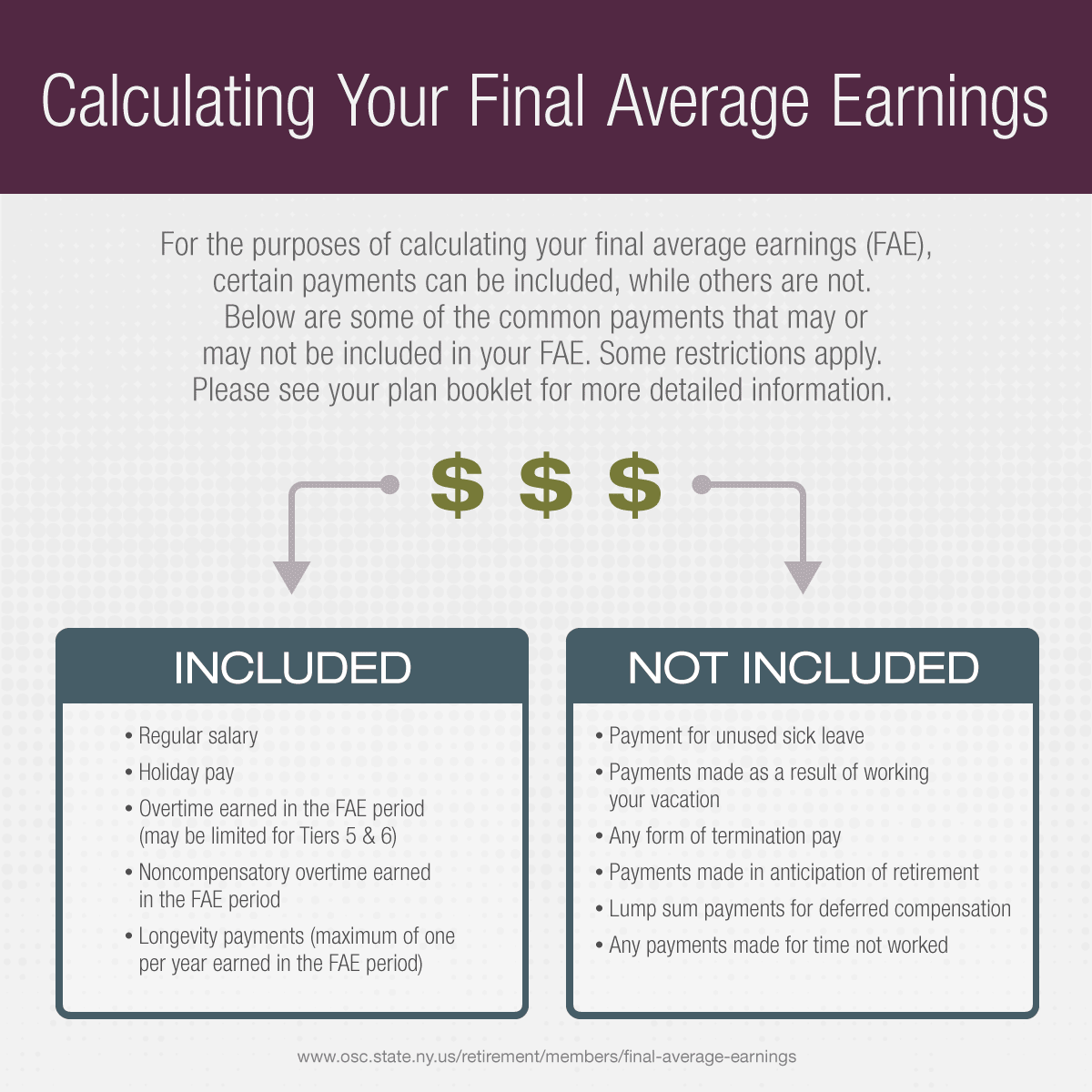

As a NYSLRS member, you have a defined benefit retirement plan that provides a lifetime pension when you retire. The formula used to calculate these benefits is based on two main factors: service credit and final average earnings. You’re probably familiar with service credit — it’s generally the years you’ve spent working for a participating employer. But what are final average earnings (FAE)?

When we calculate your pension, we find the set of consecutive years (one, three or five, depending on your tier and retirement plan) when your earnings were highest. The average of these earnings is your FAE. Usually your FAE is based on the years right before retirement, but they can come anytime in your career. The years used in determining your FAE do not necessarily correspond to a calendar year. For FAE purposes, a “year” is any period when you earned one full-time year of service credit.

Types of Final Average Earnings

Your tier and plan determine how your final average earnings is calculated:

- Three-year FAE: Members in Tier 1, 2, 3, 4 and 5.

- Five-year FAE: Members in Tier 6.

- One-year FAE: Members in the Police and Fire Retirement System (PFRS). Your employer must choose to offer this benefit. It’s not available to PFRS members covered by Article 14 and generally not available to PFRS Tier 6 members.

If you are not sure what retirement plan you are in, you may want to read our recent blog post.

Exclusions and Limits

The law limits the final average earnings of all members who joined on or after June 17, 1971. For example, for most members, if your earnings increase significantly through the years used in your FAE, some of those earnings may not be used toward your pension. The specific limits vary by tier; check your retirement plan booklet on our Publications page for details.

Since 2010, with the creation of Tiers 5 and 6, the Legislature and the Governor have introduced additional limits to the earnings that can be used toward the FAE:

Tier 5

- Overtime pay is capped — For Employees’ Retirement System (ERS), $20,763.51 in 2021. For PFRS, the cap is 15 percent of earnings.

Tier 6

- Overtime pay is capped – For ERS, $17,301 in 2021. For PFRS, the cap is 15 percent of earnings.

- Lump sum vacation pay and wages from more than two employers are no longer included in your FAE.

- Any earnings above the Governor’s salary cannot be included in your FAE.

Calculating Your Final Average Earnings

Your final average earnings is based on money earned during the period used to calculate your pension. This may include payments you receive after you retire, such as retroactive pay from a contract negotiation or pay for unused vacation days.

Calculating your FAE at retirement can take time because we must collect salary information from your employer(s) and factor in items such as retroactive payments and earnings you receive after your date of retirement. This is necessary to ensure that your pension calculation is accurate and that you receive all the benefits you are entitled to.

Find out more about how FAE is calculated on our website.